HBR: How B2B Firms Can Price with Confidence as Inflation Rises (a response)

As an executive in the Manufacturing and Distribution space, chances are this Harvard Business Review article came across your desk recently. Inflation, the spike of cost increases in commodity goods, labor, transportation, and now lead time issues have many reaching for a bottle of Pepto.

Candidly, I believe the article falls short. Well short of being truly helpful, at least.

“Prolonged inflation has not reared its head since the 1970s. While chronic inflation might not occur, companies need to hedge now against a medium- or long-term inflation scenario. Most corporate leaders have not dealt with macro inflation during their careers, leaving them unsure of how to proceed.”

The authors do a wonderful job of painting the picture we already know – margins are now compressed to eye-popping levels. Costs continue to rise and if we do nothing, the future of the organization could be at risk. This we know.

See how leaders turn data chaos into decision-ready intelligence that boosts margin.

But what are we to do?

The authors posit a handful of suggestions, the most actionable of which is appropriately positioned as the #1 driver:

Treat customers differently. Instead of blanket pricing moves, use surgical increases informed by the cost to serve, historical performance, and value to the supplier of an individual customer or segment.

Okay, let’s do that. Let’s price customers differently, makes sense.

“Some executives seem paralyzed…it’s tough to give customers bad news twice — higher prices and longer waits for the goods. Still, the current environment favors companies that act quickly to make the right pricing moves.”

What’s that you say? You don’t have a pricing scalpel capable of precise, surgical cuts of pricing of deals and products across thousands of SKUs and customers from a handful of channels to make the right pricing moves?

This is where I get frustrated, and many leaders and companies get into trouble. The strategic lever to pull is, in fact pricing. However, it can be ineffective at best and catastrophic at worst if done incorrectly. The key isn’t pricing moves, it’s the right pricing moves.

SPOILER ALERT: The “how” in making the right pricing moves is absent from the article.

The truth is there is no silver bullet. Each industry, company, and competitive environment is different. The right solution will utilize your strategy, make business sense, have a clear and proven ROI, and be fully adopted by your sales team.

Yes, the right pricing moves are important. Yes, you need to act. Together we can.

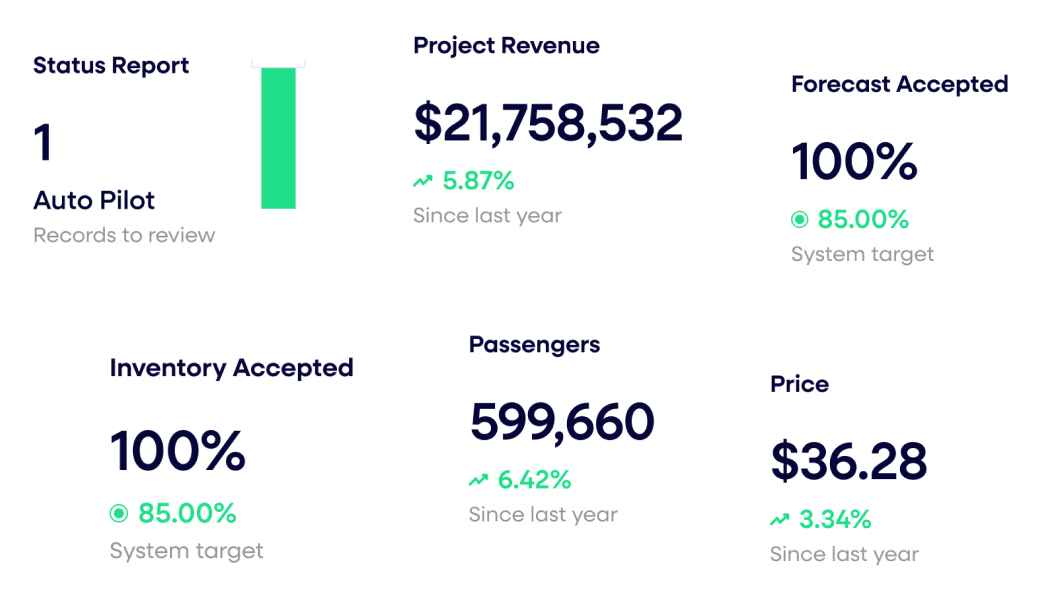

Book a time to see how we can implement prescriptive, cloud-based analytics designed and implemented by our Ph. D mathematicians, strategists, and data engineers that allow YOU to make the right pricing moves.

Last updated on October 21, 2025