The Profit Lever Every CFO Should Be Using

At any point in time, smart CFOs have one, if not many, cost-cutting initiatives underway. And because of the challenges of COVID, cost-cutting is becoming a necessity.

Why?

Chiefly, Profit = Price – Cost

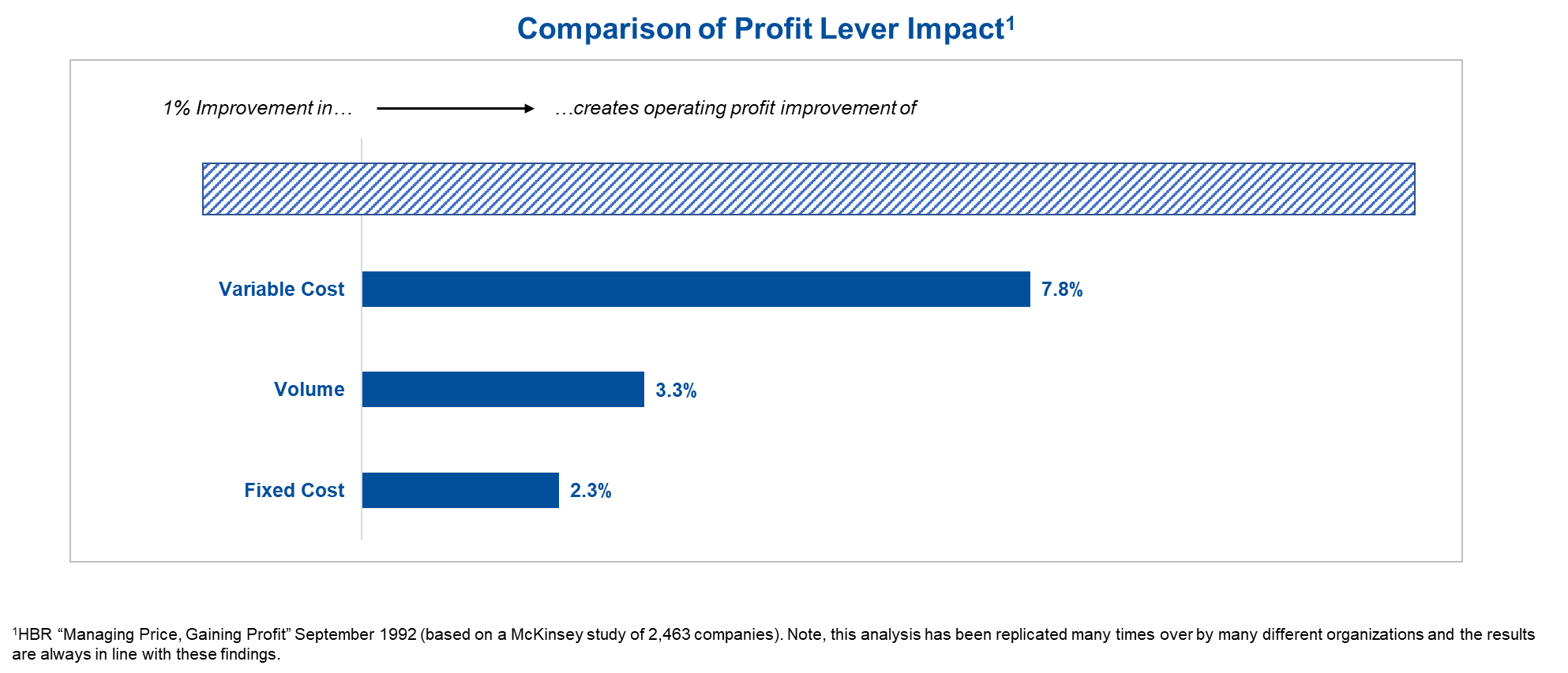

A ground-breaking study by McKinsey, published in the Harvard Business Review, found that a 1% improvement in variable cost yields operating profit improvement of 7.8%.

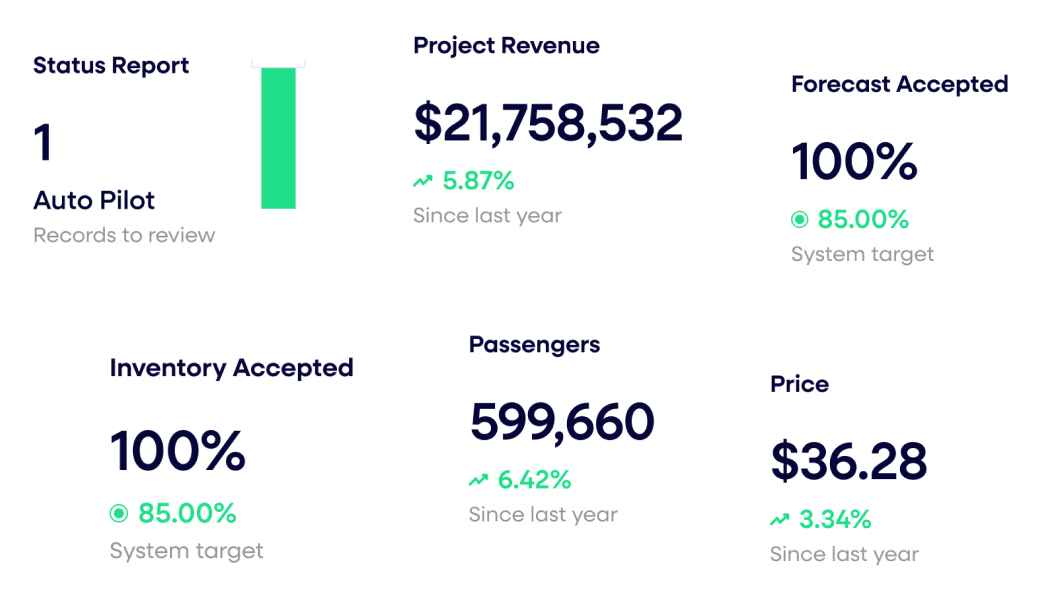

See how leaders turn data chaos into decision-ready intelligence that boosts margin.

And a 1% improvement in fixed costs returns 2.3% improvement.

Cost: The Go-To Profit Lever

Not only that, there’s always (theoretically) room to improve cost.

Plus, low cost is a competitive advantage.

Also, when economic uncertainty abounds, cost feels safe to focus on.

You can measure cost, you can exert control over cost, you can rein it in and stomp it out.

And executed correctly, cost-cutting initiatives can yield strong ROI.

A Much Bigger Lever

But, what if there was a bigger lever you could pull?

Let’s go back to the profit equation:

Profit = Price – Cost.

What about price?

For most companies, price receives far less attention.

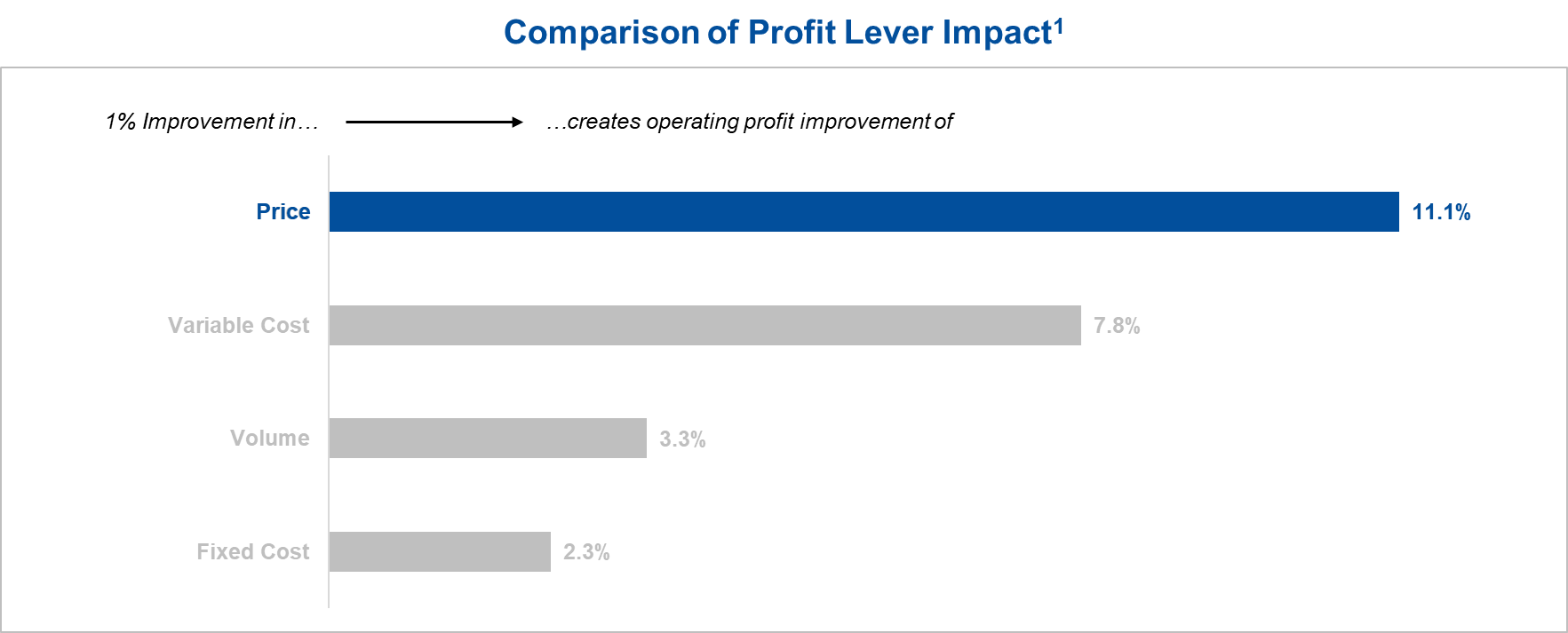

And yet it’s price, and not cost, that is the single biggest profit lever you can pull:

A 1% improvement in price creates operating profit improvement of 11.1%.

That’s a huge lever.

Pull it correctly and you could see big returns.

The challenge is most companies don’t know where to start to address their pricing, or can’t handle the scale and complexity of their pricing to make wholesale changes.

Enter Pricing-as-a-Service—our suite of prescriptive analytics engines has everything you need to set the right price for every deal, and take the right price increases over time and deliver significant profit gains.

Book a Pricing-as-a-Service demo now and take the first step to pulling the most meaningful lever.

Last updated on October 21, 2025