Why Pricing is a Value-Creation Playbook Essential

Pricing is a powerful value-creation strategy that’s often overlooked and has yet to be fully explored in the industrials sector. Even if a Private Equity (PE) firm isn’t the first buyer, significant untapped value potential from pricing can remain within a given portfolio company (Portco).

Increase Profit

There’s no lever more effective for driving profit improvement than pricing. In fact, it’s at least 50% more effective than traditional cost-out or share-gain strategies, according to a study published by the Harvard Business Review. Not to mention, it’s measurable and fast to realize, making a focus on pricing a no-regrets decision.

Pricing has a direct impact on a company’s bottom line, and even a small pricing inconsistency can significantly impact profits. This is because pricing isn’t just about setting a number, but rather understanding the value of a product and how customers perceive that value. With the right pricing strategy, Portcos can capture more value from their products, increase their margins, and ultimately drive higher profits.

Pricing strategies can also be implemented relatively quickly, allowing Portcos to see a return on investment in a shorter amount of time compared to other value-creation strategies. This makes a focus on pricing a smart and effective choice for PE firms looking to improve their Portcos growth potential and performance.

See how private equity firms turn fragmented data into repeatable value creation across portfolios.

Build Commercial Maturity

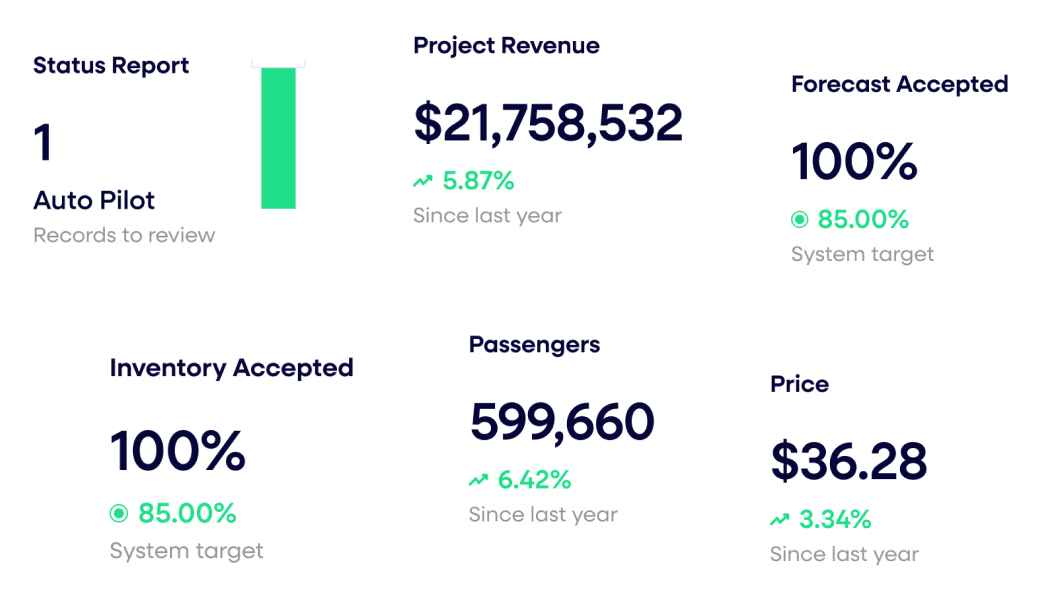

When exits finally pick up, those best positioned to reap maximum valuations are those most able to demonstrate consistent, profitable growth. Yes, past performance is a big element of that equation, but more so is go-forward potential.

Companies with a robust pricing strategy backed by reliable capabilities and processes will be best positioned to support projections of continued, and more importantly consistent, profitable growth. However, Portcos that rely solely on an annual price increase to satisfy a pricing requirement are omitting the ongoing measurement and refinement of a comprehensive pricing strategy — and are likely leaving money on the table because of it.

Improve Customer Satisfaction

When sales efficiency suffers, the market-facing implication is concerning for customers. Poor pricing can mean it takes weeks to produce a final customer-ready quote. This frustrates customers — “How can you not know the price of your own product?” – not to mention putting many deals at risk.

It shouldn’t be that hard, or that slow. To build trust, customers want to feel that the prices they’re quoted are fair and consistent, rather than feeling like the sales representative or channel determines the price. If a Portco serves customers across multiple channels, any disconnects in pricing can further erode customer trust.

Reduce Manual Work

Mid-market industrials businesses prioritize efficiency, but challenges with data handling and reliance on manual systems can complicate pricing strategies, especially for leaner companies.

For instance, consider an $180M polystyrene manufacturer where the senior vice president of sales and marketing manually sets prices. This requires them to spend a significant amount of time each month pulling multiple reports to monitor pricing trends. For Portcos in this situation, having more automated processes and less manual work is crucial to freeing up the executive team’s time so they can focus on strategy and execution to drive the business forward, rather than manually creating a Cost+ pricing model.

Mitigate Business Risk

Over the past few years, there’s been an unprecedented level of uncertainty and volatility that most people can’t recall in their professional lives. There’s a general consensus that things won’t “return to normal” anytime soon, whether it concerns cost stabilization, supply chain shifts, or macroeconomic and political factors.

However, having a robust pricing capability in place enables businesses to stay attuned to market dynamics and proactively adapt and respond over time. This empowers businesses to make pricing changes that drive growth rather than reacting to factors like cost reductions when customers request concessions.

Get Started

Pricing is the value creation lever PE leaders can’t afford to pass on for their industrials Portcos.

If you want to learn more about adding pricing to your value creation playbook, or updating your existing pricing efforts, schedule an intro with our Portco pricing expert.

Last updated on August 28, 2025