How Smarter Pricing Helps Industrials Navigate Tariff Pressures

The U.S. has once again entered a period of heightened trade tensions, as new tariffs from key trading partners continue to escalate. With steep import duties on goods from Canada, Mexico, and China, industrial manufacturers and distributors are now facing an urgent challenge: how to offset rising costs and protect profitability amid market volatility.

For mid-market industrials, particularly those backed by Private Equity, this development emphasized the need for a dynamic, data-driven approach to pricing and commercial execution. The ability to adapt pricing strategies in real time, optimize sales performance, and continuously monitor margin impact will separate those who thrive from those who struggle in this new economic reality.

The Tariff Challenge for Mid-Market Industrials

The newly imposed tariffs – 25% on imports from Canada and Mexico, along with increased duties on Chinese goods – create immediate financial and operational concerns:

- Higher input costs: Raw materials, components, and finished goods sourced from these regions now come at a significantly higher price, pressuring margins.

- Retaliatory tariffs impacting exports: Key global markets, including China and the European Union, have responded with counter-tariffs on U.S. goods, dampening demand for industrial exports.

- Market instability and inflationary pressure: Higher costs ripple through supply chains, leading to price volatility that can destabilize customer relationships.

- Uncertain supplier negotiations: Vendors may pass on increased costs unevenly, making it difficult to predict total impact and plan accordingly.

To sustain profitability and remain resilient, industrials must adopt a flexible, data-driven approach to pricing, sales, and commercial execution. This approach should account for cost fluctuations due to tariffs and enable proactive decision-making in the face of ongoing market volatility.

See how private equity firms turn fragmented data into repeatable value creation across portfolios.

The Need for a Smarter Approach to Pricing

Traditional pricing and margin improvement efforts that are often static and project-based aren’t enough for today’s fast-moving trade environment. Instead, companies need ongoing adaptive price guidance, continuous execution support, and real-time performance monitoring to protect and grow margins.

A modern, market-responsive pricing strategy should incorporate:

End-to-End Data Aggregation and Contextualization

- Consolidate pricing, sales, and operational data from disparate sources (ERP, CRM, market intelligence, etc.).

- Provide commercial performance visibility with real-time insights across customer segments, product lines, and regions.

Adaptive Price Guidance to Offset Rising Costs

- AI capabilities to generate market-responsive price recommendations that account for tariff-driven cost increases.

- Seamless integration into existing workflows (CRM, ERP, etc.) to empower sales teams to execute price changes efficiently.

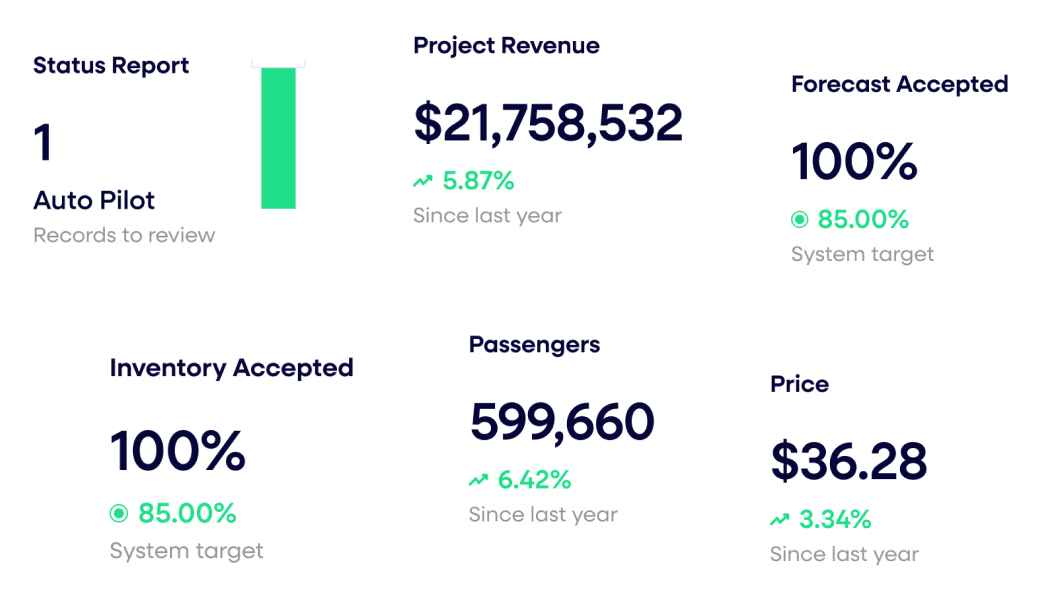

Real-Time Monitoring and Compliance Tracking

- Continuously measure price compliance, sales performance, and margin impact to minimize margin leaks and assess ROI on pricing decisions.

- Dynamically refine pricing models based on evolving market conditions to drive sustained margin improvement.

Expert Support for Commercial Execution

- Leverage pricing specialists to interpret insights, define and implement strategies, and drive adoption.

- Ensure that pricing decisions align with portfolio-wide value creation goals in PE-backed companies.

Why This Matters for PE-Backed Industrials

For these companies, the stakes are even higher. Industrials Portcos must deliver consistent margin expansion to support investment thesis execution. A reactive approach to pricing, where cost increases are absorbed rather than managed strategically, can erode EBITDA and devalue the company.

A proactive, always-on pricing and commercial optimization strategy can help:

- Drive systematic margin expansion despite tariff-related cost pressures.

- Strengthen Portco resilience by dynamically adjusting pricing strategies based on real-time data.

- Accelerate value creation with measurable, continuous margin improvement across portfolio companies.

The Path Forward

With trade tensions escalating and retaliatory tariffs in full effect, industrial companies can’t afford to take a wait-and-see approach. Rather than reacting to each new development as it arises, companies that adopt an always-on pricing and commercial performance strategy will be better positioned to maintain profitability, outperform competitors, and drive long-term growth.

The companies that successfully navigate this evolving trade landscape will be those that embrace dynamic pricing, real-time performance monitoring, and continuous optimization to turn volatility into a competitive advantage.

To see how a proactive, always-on pricing strategy can help offset cost pressures from tariffs, protect margins, and drive sustainable EBITDA growth, schedule a brief strategy call with our team.

Last updated on December 9, 2025