Costs, Customer Expectations, and Commodity Volatility

In dynamic markets moving at lightning speed, thanks to inflation, manufacturers and distributors continue to face the pressure to effectively balance costs and customers. And when your customers are watching commodity indexes as closely as you are, managing price expectations is much easier said than done. But commodities aren’t stepping out of the inflation spotlight any time soon, so how can you and your organization align financial expectations with profitability in the months and years ahead?

Commodity Volatility

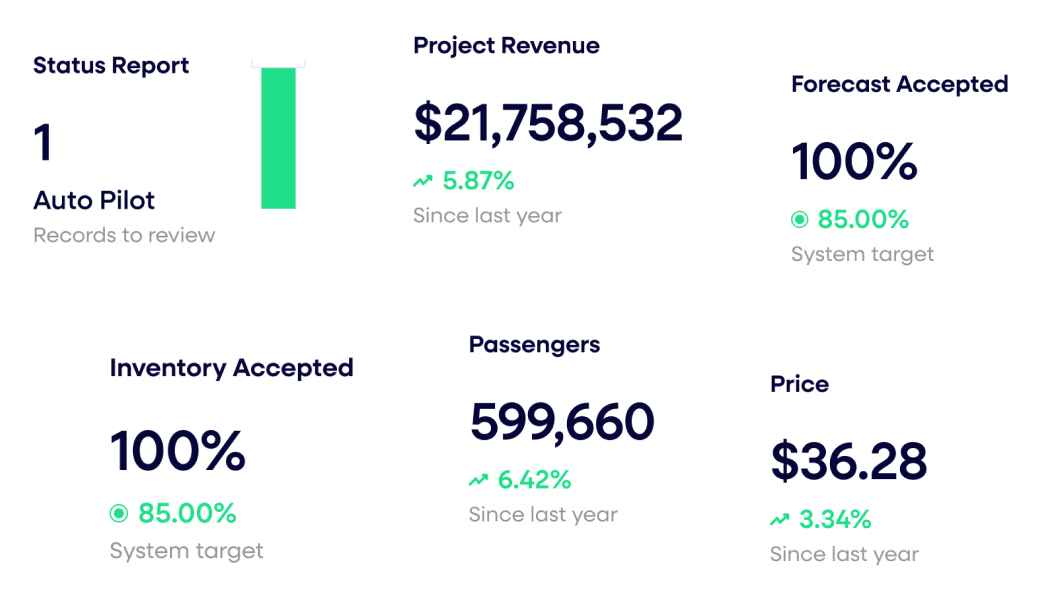

Regardless of the material – paper, plastic, metal, etc. – every commodity is unique and behaves differently from the others. Despite their differences, commodities in these categories have gone up very quickly and aggressively in price over the last few years due to inflation. And because packaging products, regardless of material, are so cost-focused and customized, everyone, including your customers, is aware of commodity indices. So as commodity prices start to stabilize or even come down – we’ll use containerboard as an example today – customers expect price decreases.

United States – Producer Price Index by Commodity: Pulp, Paper, and Allied Products: Corrugated Shipping Containers (last 5 years)

Source: Trading Economics

The crux of the problem is aligning financial expectations. As a manufacturer or distributor, you don’t want to give back all your margin gains at once, but your customers are already expecting a decrease in one form or another. And if the products you provide are uniquely customized or configured, the bill of materials (BOM) will vary.

Take two products, for example, where containerboard makes up 40% of the cost for one, but 80% of the cost for another based on composition and other configurations. Instead of being able to simply give your customers buying these products a 5% price decrease when containerboard goes down 5%, you need to take a more surgical approach to account for other variables in the mix.

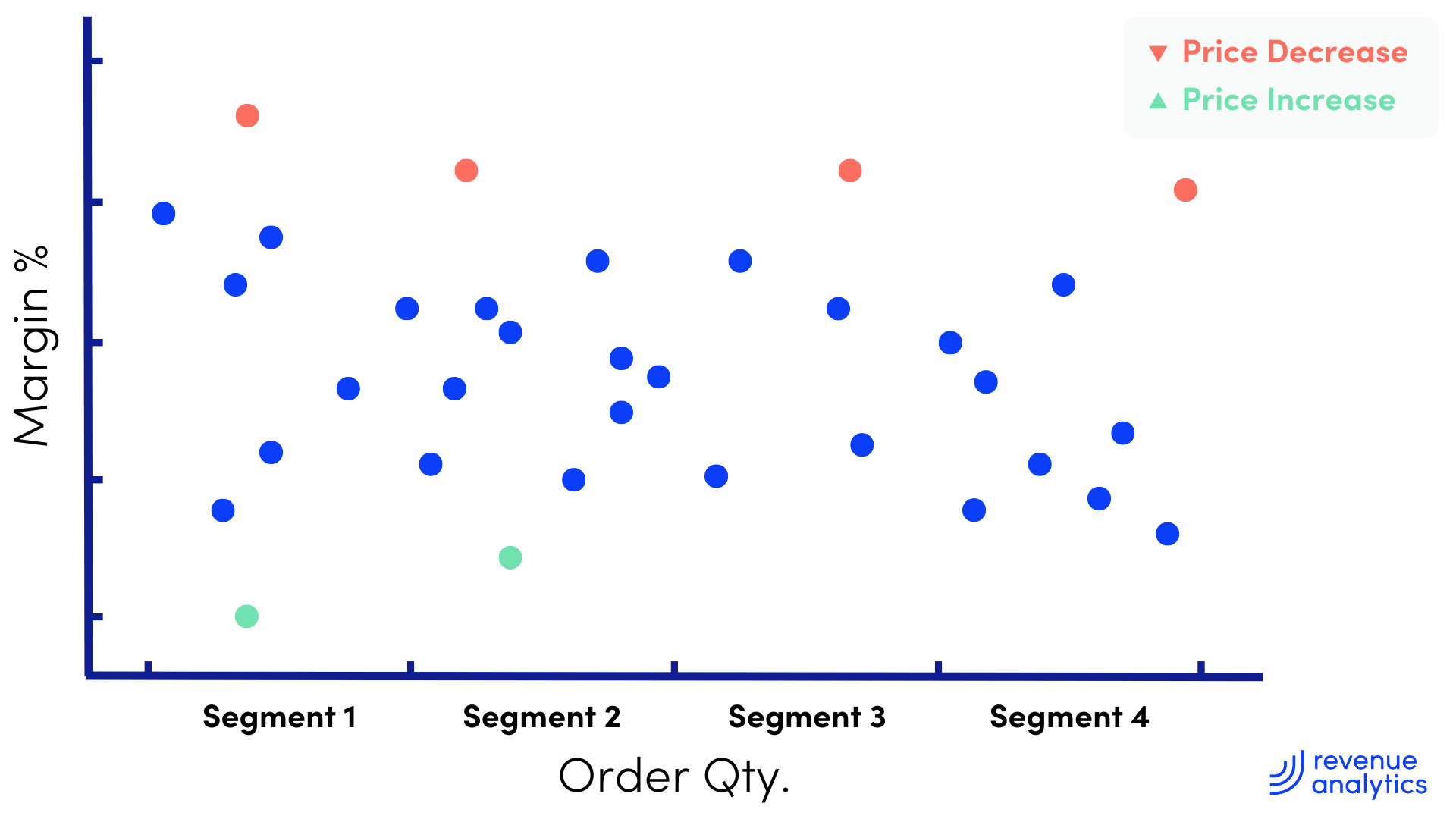

The next layer of complexity is where your customers lie in terms of price and customer value relative to their segment of comparable customers. If they’re far below similar customers, then they should actually be considered for a price increase regardless of commodity activity. And vice versa — if they’re above other customers in their segment, it could be a great opportunity to give them a price decrease to reduce the risk of losing them as customers.

When considering a price increase, the biggest concern quickly becomes justifying it to your customers (not to mention your sales reps, who hate having to go back and ask for more). Counterintuitively, this was easier during inflation. All costs were going up, so while your customers likely didn’t enjoy paying more, they understood why. We were all experiencing the same thing in our daily lives, too, which helped normalize it to some degree.

It’s an easier conversation when you can point to an index that shows containerboard up 105% and only take a customer’s price up 4%, compared to when they can see a commodity come down 5% and only get a 1% decrease.

Other Cost Inputs

Commodities are just one piece of the puzzle – there are a variety of other major inputs that make up the total cost of a sale. Some may be new, and many are behind the scenes and never seen by customers, making them more difficult to substantiate and leaving your customer’s mindset unchanged: commodity cost down = price decrease. They see the indices, but not everything else that goes into the products they purchase – like having to increase production with fewer employees, highly specialized labor, and freight costs, among other things.

But the reality is that not all commodities are down, and most manufacturers and distributors are dealing with a mixed bag of commodities that are going up, holding fairly steady, or starting to go down. Amid volatile commodities and a variety of other tangible and intangible cost inputs, the best solution is to get granular.

When everything is going up, it’s easy to take a broad brush to price increases, and vice versa. But when you work across a variety of commodities, customers, and products, you find out quickly just how profit-critical the details become.

Managing commodities, costs, and customers is a multifactorial challenge that demands a detailed solution – which is why we built Pricing-as-a-Service just for manufacturers and distributors. It combines your business’s unique strategy, products, and data with our technology and experienced team to provide profitable, ongoing price guidance you can trust in any market. Schedule a 1:1 with a pricing expert to learn more about how we can help solve your complex pricing challenges for you.

Last updated on October 17, 2025