GenAI for Pricing? The Future vs. The Now, and Where to Start

In 2011, Mark Andreeseen famously wrote, “Software is eating the world.” Fast forward to today, and the rapid rise of GenAI seems to have taken software’s eating habits from small nibbles around the edges to massive bits of the core. Everyone is talking about it, many are experimenting with it, and some have found value-driving use cases to deploy it. And it’s all happening very quickly (for those new to the topic, here’s a great primer on what GenAI is and how it works).

While GenAI’s potential is nearly unlimited and not yet even fully understood, none of the hype matters until a company successfully uses it to deliver incremental value. There are many plausible use cases to explore, but our focus is on leveraging GenAI to help manufacturers and distributors drive greater pricing results.

Picture these potential use cases:

See how private equity firms turn fragmented data into repeatable value creation across portfolios.

A sales rep speaking on the phone shares details about a customer’s request for quote. GenAI used on the phone may ask clarifying questions or request more details. Then once the dialogue is complete, the GenAI instantaneously delivers the exact right price to charge for the quote and asks where to send the pre-populated quote form.

Or, a Finance lead pulls up their daily flash report and notices margins are trending down versus last quarter. They pull up their GenAI plug-in (that’s connected to the company’s underlying data sources) and ask: “Why are margins down since last quarter, and what actions should we take to improve margin?”. The GenAI quickly sends back a response, including explanatory text and supporting data, pinpointing where and why margins have decreased, and proposes an action plan to course-correct.

Cool, right. Possible? Yes, and no.

GenAI technology already exists for these use cases, but it’s unlikely to go that smoothly or be that precise in its recommendations today. That’s where the practicality of what’s needed to make this work and what it can theoretically do collide. While the technology is capable of such an outcome, like most things in the data and analytics realm, it’s all in the setup.

The three primary areas one must address to enable GenAI to make better pricing decisions are:

- Data: What data you feed the model, how it’s structured, its accuracy, completeness, and how it’s attributed will all play a critical role in what GenAI can do. The more limited or messy the data, the greater the limitations and the more likely the results aren’t reliable. But if the data is complete, accurate, and contains all the granular data elements one would need to inform a decision, then the potential is there. For example, in the Finance use case on margins declining, you’d have to include data over the relevant time period, include all relevant data elements that could be driving the performance (products, customers, sales transactions, etc.), and the related attributes (ex: granularity on geography, time, and customer characteristics) to deliver a useful and accurate breakdown on the margin drivers.

- Training: GenAI models on the market today have already been trained on large data sets to build their depth, breadth, and accuracy. But when it comes to applying them to your specific data, you’ll need conduct finite training on everything from basic data mapping (ex: if the Finance lead typed “margin” as part of his prompt into the GenAI plug-in but the company labels that calculation as “profit” in their data, then the GenAI won’t know what to do) to fine-tuning results and recommendations based on what you’re looking for (details, structure, visuals, etc.).

- Human buy-in: Humans are naturally resistant to change, and even more so when it comes to technology that can feel threatening or black-box. Even if you nail the data setup and model tuning, gaining the trust of your organization to use the technology and act on the insights is an essential step in getting real value out of GenAI. There’s no silver bullet here, but bringing folks along on the journey, finding the “what’s in it for me”, then testing, learning, communicating, and iterating are all helpful elements of an adoption plan.

Once you have the foundation in place, the question becomes which use case(s) to start with. In our experience, it’s best to start where GenAI (in today’s form) is best suited and feels least threatening to users — using natural language prompts to analyze large data sets, identify insights, and synthesize findings to support decision making. Starting here positions GenAI as a decision aid, not a resource substitute, and shifts stakeholder time from manual analysis to strategy and execution. Done right, that’s a win-win for the company and user.

What does that look like in a pricing context? Here’s a couple real-world examples from our customers:

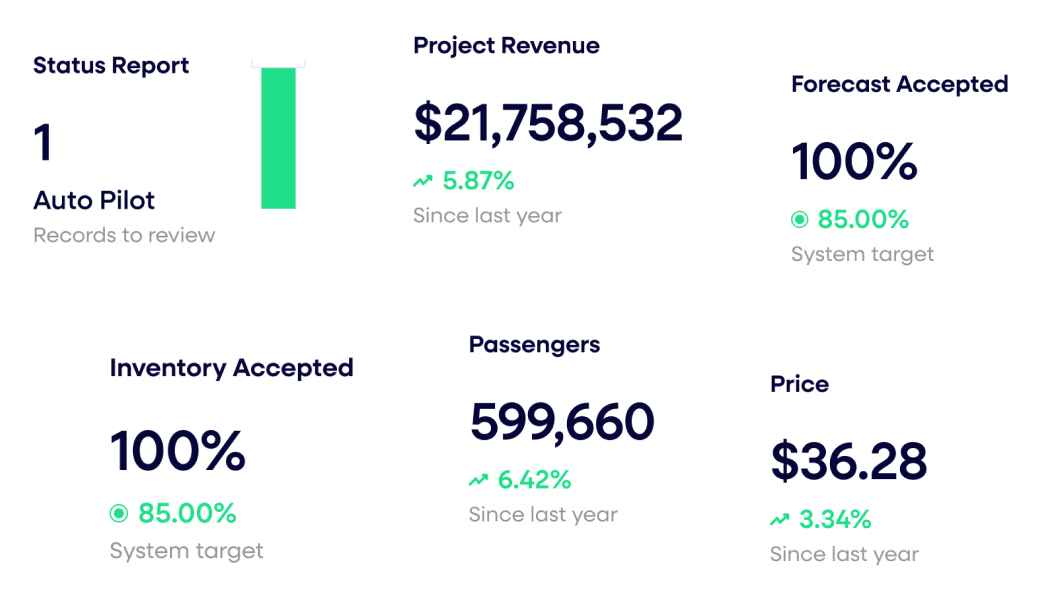

An executive at a mid-market manufacturing company was leading an initiative to reduce unnecessary price discounting. Wanting to take targeted, data-driven actions, they turned to the GenAI plug-in on their BI Dashboard and entered, “Show me the top 5 customers with the highest discount to target price.” A moment later, a chart appeared on the screen showing the top 5 customers with the largest discount from the intended price. From there, the executive conducted further prompts to discover which products were being most heavily discounted and the sales reps on each customer account. Armed with that information, they could now put together a plan to recapture that lost profit.

A sales operations manager at a building products distributor needed to conduct a detailed analysis of sales performance by region and product category over time. Usually, such an effort would require asking IT for a data pull from their ERP and CRM systems, then multiple iterations to get the exact right columns of data and level of granularity. But now, with a GenAI plug-in sitting on top of their technology stack, the manager could simply type in, “Show me by region and by product category sales and profit and [fill in the blank for all desired data columns] from Q1 2022 to Q1 2024.” A moment later, a table appeared with the exact dataset requested. From there, quick edits could be made if desired, then the data downloaded to conduct the analysis.

How many resources spend most of their day with these types of use cases, and because it’s manual, spend 90% of the effort getting access to the data and only 10% analyzing it and acting? Using GenAI to be your pricing insights sidekick is a fantastic way to boost productivity, build understanding of the technology, and lower adoption resistance, all while leading to insights that will boost pricing performance.

Last updated on August 28, 2025