5 Ways to Ensure Pricing Adoption for Value Creation

Private Equity (PE) firms play a crucial role in driving value creation within their portfolio companies (Portcos).

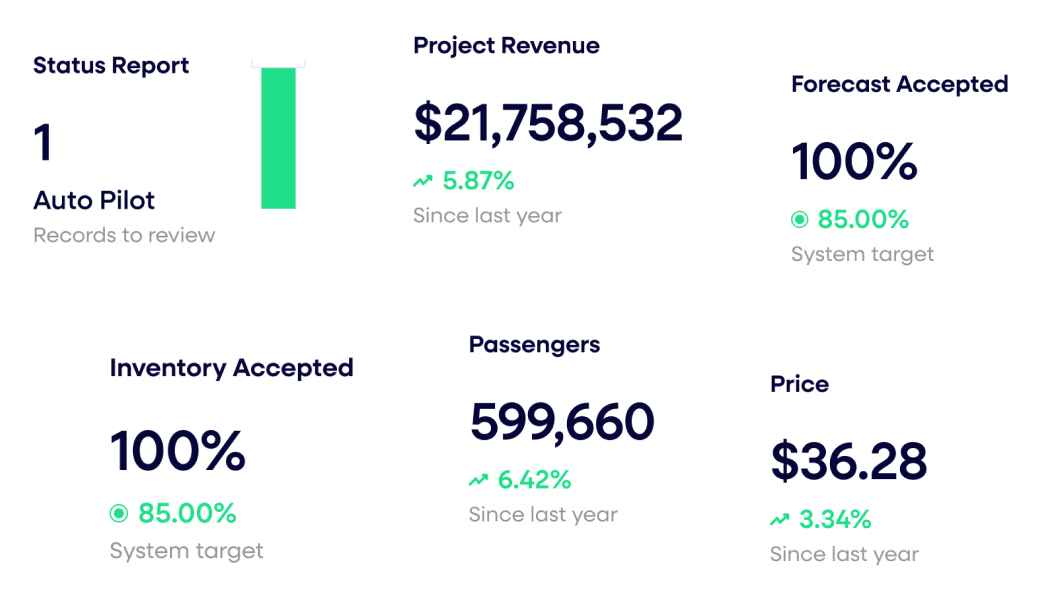

One key strategy for creating value through profitability is strategic pricing, which outperforms traditional profit improvement strategies by over 50%.

However, the fear of low adoption can hinder the pursuit and successful implementation of strategic pricing as a value creation lever.

Leverage your content to achieve stronger revenue outcomes

Learn more about the 5 common challenges to pricing adoption faced by Portcos and how PE leaders can support them to overcome adoption hurdles and ensure another successful value-creation initiative.

- Change management reassurance: Some Portco functions may resist new value creation strategies like strategic pricing due to fear of change, or perceived infallibility in their own price judgement or current process. Sales is particularly susceptible and should be provided with ample proof that the benefits of strategic pricing can be realized and what’s specifically in it for them, while also being reminded that any new pricing solution is being added to complement their existing customer and product expertise, not replace it. Seek sales input throughout the process to build trust and competency, while soliciting feedback that will ensure the price recommendations fit the business and are adopted.

- New technology encroachment: In the same way that the emergence of generative AI tools like ChatGPT won’t replace all writers, tech-enabled pricing solutions aren’t intended to replace a pricing team or experienced sellers. Instead, they’re meant to work alongside human expertise to provide data-driven guidance and insights to make pricing more profitable, visible, and scalable.

- Leadership confidence: The Portco leadership team is ultimately responsible for adoption. As the executive sponsor of value creation initiatives, PE leaders can help set the example by playing a very visible, supportive role throughout the process. Empowering strong leadership will only help the effectiveness of strategic pricing, in turn generating more results and creating more value.

- Context setting: Not all pricing initiatives and approaches are created the same. As PE leaders suggest a focus on pricing to their Portcos, it’s essential to provide context surrounding why pricing should be a focus, pricing’s connection to the Portco’s growth strategy, and rationale behind the recommended tools or partners to help address any areas of concern.

- Timeline prioritization: Any organization-wide shift is difficult, and your Portcos are no different. A variety of initiatives are being discussed constantly on both sides, but there’s a finite number of them and amount of time available to take the Portco’s value from X to Y. While pricing can be perceived to be a longer-term initiative, working with your Portco on a solution that can be implemented quickly can provide some quick wins that can be used to encourage continued adoption.

Ensuring pricing adoption for value creation within portfolio companies is a critical task for PE leaders. With a strategic and proactive approach, PE leaders can unlock the full potential of strategic pricing and maximize the success of their value creation initiatives.

To learn more about the only pricing solution built for adoption first, talk to a Portco pricing expert.

Last updated on August 28, 2025