2025 Planning: The Year to Prioritize Pricing and Profitability in PE Portfolios

As Private Equity (PE) firms begin the annual planning process for their portfolio companies (Portcos), 2025 presents an environment where financial engineering alone won’t be enough to deliver expected returns. With higher interest rates and economic uncertainty continuing to impact the market, leading firms are pivoting toward intentional operational improvements, like strategic pricing and margin expansion, to drive profitability across their portfolios.

This shift is more than a reactive measure, it’s a strategic move toward sustainable growth, especially for Portcos in mid-to-late hold periods. Without the right capabilities in place to continually identify and capture margin opportunities, Portcos risk seeing profits erode and valuation suffer in an increasingly competitive landscape.

Lessons Learned from 2024

After reflecting on 2024’s performance, PE and Portco leaders are prioritizing profitable, organic growth levers for 2025. Boardroom discussions are focused on either driving top-line growth or expanding margins, with the latter emerging as a preferred strategy in today’s climate.

“Margin and revenue trump financial engineering,” notes Bloomberg, underscoring that financial restructuring alone can’t meet today’s market demands. Bain & Company’s 2024 Global Private Equity Report echoes this shift, as the industry leans toward operational and commercial improvements as top value-creation levers.

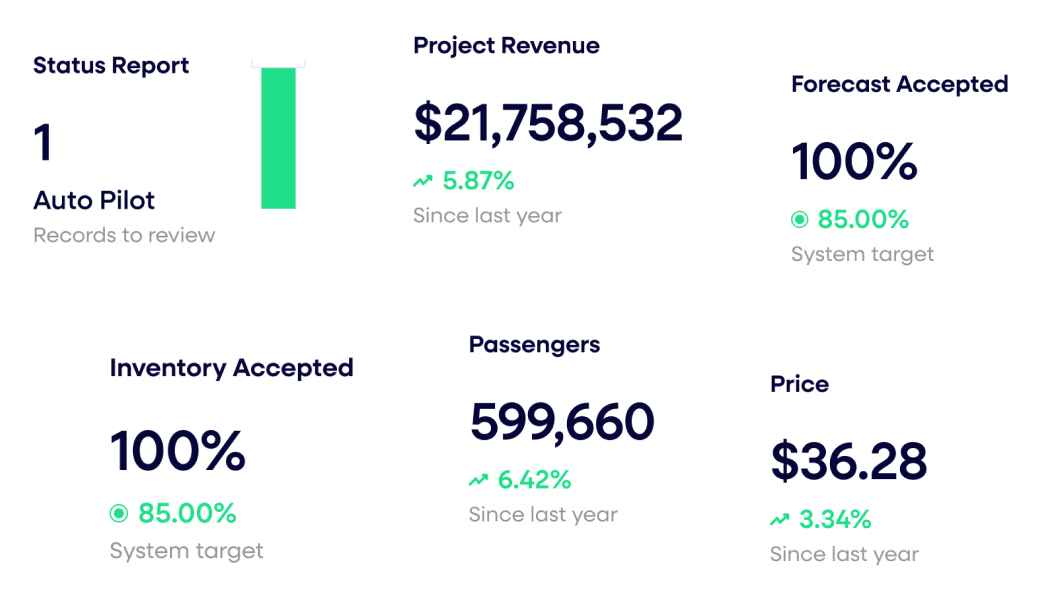

Leverage your content to achieve stronger revenue outcomes

However, strategic pricing remains underutilized despite its high impact on margins and its ability to unlock measurable value in today’s constrained market.

Margin Over Growth at All Costs

Entering 2025, post-election clarity and potential interest rate shifts may reduce some uncertainty, but the economic environment remains complex. Rising borrowing costs and modest growth projections will keep margin expansion at the forefront of value-creation strategies.

For mid-market firms, this means that strategic pricing initiatives, often secondary to revenue-focused strategies, will be essential for capturing profitability at every opportunity. In fact, Bain’s 2024 PE Report shows that companies with robust pricing strategies saw margin improvements of up to 10% last year, a powerful indication of the gains Portcos can realize by making pricing a central focus.

PE and Portco leaders are increasingly asking critical questions:

- How can we sell more, but at a higher margin?

- How do we ensure that sales teams remain compliant while optimizing price points?

- Are we equipped with real-time data to make informed pricing decisions?

These questions highlight a critical area of vulnerability for Portcos: pricing decisions that rely on outdated practices or lack data-driven insights can erode margins quickly. And according to McKinsey, companies that rigorously apply advanced pricing techniques achieve 2–7% higher margins than their peers — a competitive advantage Portcos can’t ignore.

The Role of Strategic Pricing in 2025 Planning

Strategic pricing offers one of the most powerful, yet frequently overlooked levers for margin expansion. By implementing proactive, data-backed pricing strategies, PE-backed companies can unlock significant profitability without requiring new capital investments.

This approach makes strategic pricing particularly valuable for Portcos nearing exit, as it both strengthens their competitive positioning and boosts earnings. Companies actively improving pricing discipline and adopting advanced pricing tools can see EBITDA margins increase by 3–8% according to KPMG, providing immediate financial impact and a lasting foundation for growth.

By making strategic pricing a focal point in their planning discussions with Portco leadership, PE firms can ensure that value-creation plans include actionable steps toward commercial margin expansion. This involves:

- Analytics for Optimal Pricing: Leveraging advanced analytics so Portcos can set the right prices and capture revenue and margin gains that static models miss.

- Improving Price Compliance: Training sales teams to adhere to pricing guidelines is critical, as inconsistent practices can rapidly erode hard-won margins.

- Visibility for Actionable Insights: Clear insights into price performance help PE firms see what works, identify gaps, and make data-driven adjustments that directly impact growth.

Bringing strategic pricing to the forefront of planning discussions not only supports margin expansion goals, but also positions Portcos to meet evolving market demands profitably.

Commercial Margin Expansion for Mid-to-Late-Hold Portcos

Portcos in the mid-to-late stages of their hold period stand to gain the most from a focus on margin growth. With exit opportunities expected to increase in 2025, Portcos that have optimized margins will attract premium valuations.

Bain’s 2024 PE Report also notes that PE exits are increasingly rewarding firms with sustainable, defensible margins over those focused solely on revenue. By refining pricing strategies now, PE firms can better position their Portcos for a successful exit.

Margin expansion strategies for these Portcos should include:

- Product Rationalization: Identifying low-margin products and either discontinuing them or adjusting pricing to capture additional value.

- Data Cleanup: Cleaning and consolidating Portco data to ensure pricing strategies are built on accurate, comprehensive insights. Poor data quality can lead to pricing errors and missed opportunities.

- Customer Segmentation: Segmenting customers by purchasing behavior, industry, or profitability can help Portcos tailor pricing strategies that maximize value capture from each segment.

By investing in data cleanup and refined customer segmentation, Portcos can create more defensible margins and a stronger competitive position, making them more appealing to buyers and investors at exit.

Reducing Risk Through Pricing

Mid-market PE firms can no longer afford to place multiple small bets and hope for a hit. Each investment, whether in sales teams, product lines, or acquisitions, needs to be carefully considered for maximum returns.

Strategic pricing offers a way to reduce risk by enhancing predictability in margin improvements, giving PE firms the confidence that each investment is well-founded.

To strengthen 2025 strategies, PE firms must ask whether their Portcos have enough visibility into pricing to drive results.

Are Portcos equipped with the insights needed to ensure their bets are sound? Is the data they’re using actionable and capable of producing measurable ROI? These are vital considerations as PE firms seek to balance risk with reward in a constrained environment.

Staying On Track in 2025

Annual planning isn’t confined to a single meeting but requires continuous adjustment throughout the year as new data becomes available and market dynamics shift.

Pricing should be a consistent part of quarterly reviews, with strategies revisited and refined in response to real-world performance and emerging market trends. Continuous pricing support helps Portcos not only reach margin targets but also stay competitive as market conditions evolve.

Making Strategic Pricing a 2025 Priority

In 2025, mid-market PE firms must prioritize commercial margin expansion through strategic pricing to capture sustainable value. Shifting focus from growth at all costs to profitability ensures that each Portco in the portfolio is primed for margin improvement and competitive advantage, even in a softening economy.

By leveraging data-driven insights, ensuring compliance across sales teams, and refining pricing strategies continuously, PE firms can unlock significant portfolio value.

As your 2025 planning cycle kicks off, put strategic pricing at the top of your agenda. This lever offers an immediate path to profitability and positions Portcos for a stronger exit, and ignoring it could mean leaving valuable returns on the table and missing out on competitive opportunities in the year ahead.

If you’re ready to get started, book an intro with our PE team.

Last updated on August 28, 2025