Improving Price Realization – A Silver Bullet for Private Equity’s New Math

Is a 1.2% price improvement really equivalent to a 13% change in multiples? Yes. It may be hard to believe, but it’s true. Let’s walk through an anonymized real company example to see the power of pricing in action.

| EV @ 2022 Purchase | |

|---|---|

| Revenue ($m) | $200.0 |

| EBITDA ($m) | $16.0 |

| Valuation Multiple | 12.1x |

| Enterprise Value ($m) | $194 |

A Private Equity (PE) company purchased a $200M building materials manufacturer with 8% net profits in early 2022. At the time, they paid 12.1x enterprise value (EV) to EBITDA multiple, suggesting a $194M EV.

| EV 2023 | |

|---|---|

| Revenue ($m) | $200.0 |

| EBITDA ($m) | $16.0 |

| Valuation Multiple | 10.5x |

| Enterprise Value ($m) | $168 |

In 2023, EV to EBITDA multiples dropped from 12.1x to 10.5x, wiping out $26M in enterprise value.

| EV mid-2024 w/ 1.2% Price Improvement | |

|---|---|

| Revenue ($m) | $202.5 |

| EBITDA ($m) | $18.4 |

| Valuation Multiple | 10.5x |

| Enterprise Value ($m) | $194 |

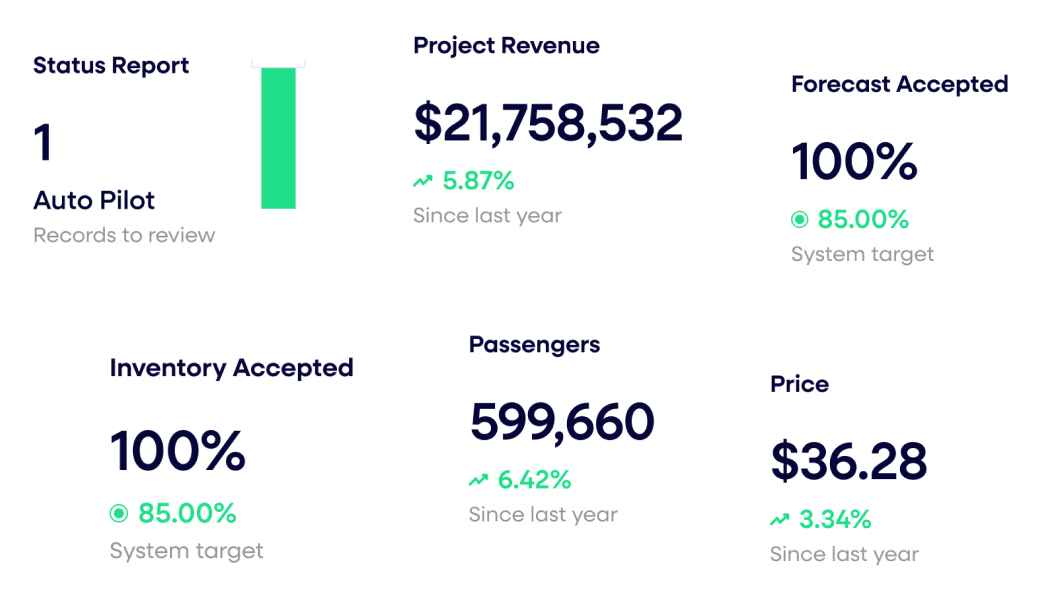

Undeterred, the PE firm and portfolio company (Portco) acted, seeking help to eliminate unnecessary discounting in their quoting process for new customers. The result of that effort was a 1.2% price improvement yielding $2.5M in incremental revenue, nearly all of which flowed to the bottom line (minus incremental sales commissions). The resulting EBITDA growth fully offset the EV hit from the multiples decline.

See how private equity firms turn fragmented data into repeatable value creation across portfolios.

The new “worse case” if multiples remain depressed is a full EV offset. And that’s with very risk-adverse price actions that only yielded a 1.2% price improvement.

| EV if Multiples Rebound | |

|---|---|

| Revenue ($m) | $202.5 |

| EBITDA ($m) | $18.0 |

| Valuation Multiple | 12.1x |

| Enterprise Value ($m) | $223 |

What if multiples rebound? If multiples return to the average 2022 rate of 12.1x, then EV for this company shoots up to $223M!

Under any scenario, those choosing to improve pricing will come out ahead. As PE firms and their Portcos work to create true sustainable value, pricing should be top of the list of levers to pull.

Last updated on December 9, 2025