Execs, place your bets!

As a Manufacturer, you have an endless number of things to tend to – digital transformation, labor issues, fluctuating costs of goods, and of course the endless quest to reduce costs.

You’re trying to find the best odds.

So, why prioritize pricing?

THE PAYOFF.

See how leaders turn data chaos into decision-ready intelligence that boosts margin.

Here’s what I mean—as a leader, you must select where you make investments of time, money, assets, etc. A fun view of this could be like walking through a casino and evaluating the different options that are available. Surely, you’re going to want to maximize profit, so that’s the lens you’re viewing these tables through.

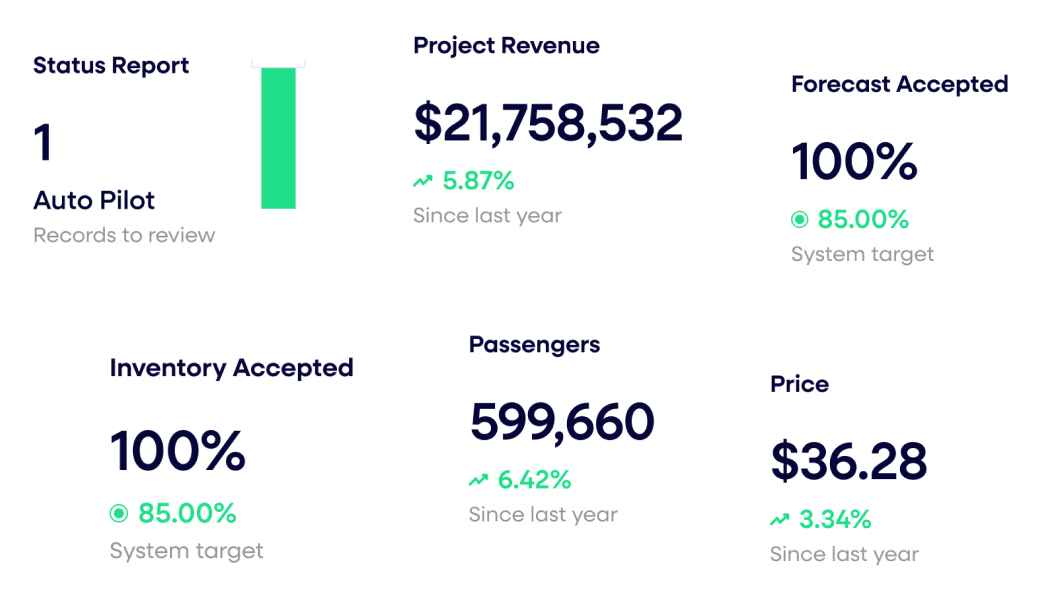

First up, it’s cutting fixed costs. As Manufacturers you know that cutting fixed costs can warm the heart; but the truth is undeniable – the payout odds on a 1% improvement there only yields a profit impact of 2.3%. Your time is too valuable for that game.

You keep walking, and a new game catches your eye. Well, this one is attractive – who doesn’t love increasing volume!? Economies of scale, better usage of overage, putting assets to work that are dormant. Feels great, right? Well, the payoff isn’t much to write home about. A 1% improvement in volume only generates 3.3% profit impact. Disappointing, right?

Hopeful you’ll find better payout odds, you continue going deeper into the windowless lair of this casino… and BOOM. There it is. FINALLY. Variable costs: a payout worth discussing. The ability to spend time and invest against variable costs is a very friendly payout. 1% improvement in variable costs delivers an admirable 7.8% profit impact. That’s what we’re talking about!

You settle in, sit down, try to make eye contact with the beverage server with a slight smile and get ready to invest in the variable costs improvement game. But then…

OOOOOOOHHHHHHH!

You jerk your head up, ears directing your eyes left then right to focus on the loud cacophony emitting ahead. People are cheering, yelling, high-fives flying, and smiles are plastered to every face at this table. More and more gather around to see what the hubbub is about – and then they also get quickly sucked into the action.

We must find out what this is. You snatch up your coin and head over to the table that’s making the noise. You hear the dealer announce to a hushed crowd, “Another winner, 11% profit impact!” and the chips pay out to all at the table. You look up at the sign detailing the action, and it reads “PRICING”.

Hmph, you think. Pricing? THAT much impact?

Yes, a 1% improvement in pricing delivers an 11% impact to profit1.

THAT’S where you should place your bets. THAT’S why to prioritize pricing.

Thinking of finally prioritizing pricing? Book a risk free, 1:1 session with our manufacturing pricing professionals today.

[1] Marn, Michael and Rosiello, Robert, “Managing Price, Gaining Profit”, Harvard Business Review

Last updated on October 22, 2025