Sick of Your Ad Inventory Being Undervalued? Here are 3 Solutions.

Not only is radio experiencing a renaissance of sorts thanks to explosive growth in the audio landscape, but TV continues to lead in terms of daily media usage. Both mediums tout high ROI, low CPMs, and a high level of trust from consumers.

Yet most broadcasters in traditional media agree: it’s an undervalued and underpriced advertising medium.

Why is that happening? And how can broadcasters raise rates to be reflective of this value and convince the media buying community to get on board?

Below are 3 solutions to help you get the higher rates your inventory deserves.

#1: Back that ROI Up

One of the primary reasons radio and TV ad inventory is undervalued is that rates have traditionally been based on ratings, not ROI. If rates were based on ROI instead, broadcasters could charge more because of the high value. But while TV and radio have long touted their ROI, they haven’t been able to sufficiently prove it, until now.

With advances in media targeting and new ways to measure the effectiveness of TV and radio ads, broadcasters can put actual data behind their long-running claims of high ROI.

In the television space, smart TVs and set top boxes provide audience insights that let advertisers target consumers at a much more granular level than just basic household demographics—the norm in TV buying for decades. This level of specificity in targeting increases the effectiveness of an ad and allows the TV industry to compete with the sophisticated capabilities that have made digital advertising so appealing.

In fact, overlaying this audience data with advertiser website visits and purchase metrics to measure effectiveness has put TV on the same playing field as digital.

In radio, broadcasters’ ability to measure ad campaign performance has also advanced by leaps and bounds over the last few years. By matching when/where a radio spot airs to an advertiser’s website metrics, radio has found a way to quantify the impact of traditional broadcast advertising. This real-time look at performance metrics gives advertisers the ability to make in-flight optimizations, which makes for more effective campaigns, and increased advertiser spend and retention.

These abilities to offer advertisers greater audience data and prove ROI help switch the basis of ad valuation from ratings to the actual effectiveness of TV and radio, where they have an edge over other mediums.

#2: Three’s Company—Create New Channels of Communication

The communication between broadcasters and agencies, and broadcasters and advertisers, is challenging and it’s another core reason ads are undervalued.

At the 2019 Radio Show, Bob Pittman talked about the strong ties that radio broadcasters have long had with agency buyers. But he noted that there’s rarely any communication between broadcasters at higher levels within ad agencies or directly with national advertisers themselves.

Lacking a direct relationship with advertisers is a common scenario for broadcasters of all sizes and poses a problem for significant growth in ad spend within the medium.

Why?

Agency media buyers simply execute on a media strategy—a media strategy that has already been determined by the advertisers in advance. By the time agency media buyers are involved, decisions about how much ad budget to allocate to channel—radio, TV, digital, etc. —have already been made.

That means conversations and negotiations between broadcasters and agency buyers revolve around maximizing share of spend within a budget that has already been allocated for the medium. At this stage of the conversation, the best-case scenario is gaining a small increase in dollar share from previous campaigns—typically gained at the expense of other broadcasters.

If broadcasters don’t establish direct relationships with advertisers and with agency execs—that operate above the agency buying group—they won’t be able to influence decisions about how to allocate dollars by channel. That’s where the real gains can be made and where broadcasters have a strong case for increasing spend significantly based on high ROI from new platforms and advancements in targeting and tracking.

Agencies are now under fire from advertisers and broadcasters for their lack of transparency. For example, advertisers are frustrated that details of media executions are often withheld from them. And broadcasters have long felt that agencies stand in the way of meetings with advertisers.

This lack of transparency has driven advertisers to make major changes in their agency relationships, and agencies are feeling the heat. In fact, a new ANA report finds that 69% of advertisers have updated their media agency contracts in the last three years. And major advertisers like P&G have started experimenting with their media business, taking a portion of it in-house.

As a result, agencies and advertisers are now more receptive to direct conversations with broadcasters, so there’s an opening for broadcasters to tout the value of radio and TV with data-backed stories on ROI.

This strategy of a triangular partnership between broadcaster, agency, and advertiser will help pave the way for an increase in mindshare—and budget—for traditional media.

#3: Increase Revenue with Pricing Analytics

Clearly, there’s a case for raising rates in the broadcast space. But finding the right approach to accomplish that is overwhelmingly complex.

Which rates do we raise? By how much? How will the market respond?

It’s impossible for a human to compute all the scenarios necessary to answer these questions comprehensively and accurately, but predictive analytics is designed to do just that.

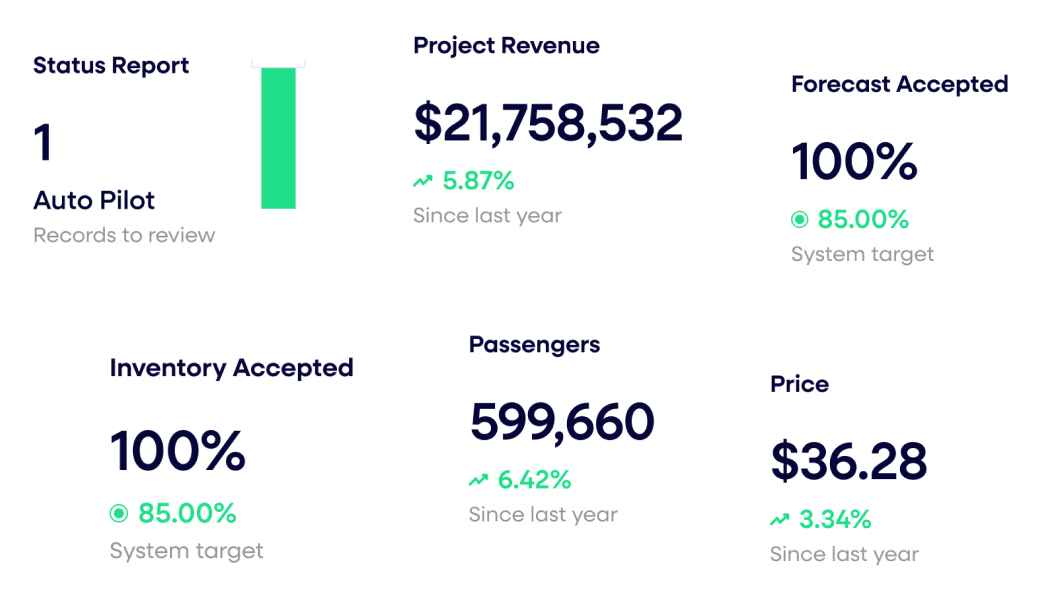

Predictive analytics software can mine historical data to understand past transaction volume, ratings, market demand, and price elasticity and use that understanding to determine the best price for inventory, down to the station and segment-level.

The process takes a matter of seconds, and ensures you are pricing inventory at rates that help you close more deals, close them faster, and capture fair margin dollars in the process.

A Defining Moment for Traditional Broadcast

It’s clear that the tide is turning for traditional broadcast.

The ROI for TV and radio can now be proven with data. There’s never been a better time to showcase the benefits of traditional media to agencies and advertisers, using this data to back the story. And predictive analytics has entered the scene to help put the perfect price on that ROI.

And as the perception of radio and TV continues to improve, media organizations have a rare opportunity to take advantage of this momentum.

Need some help boosting the value of your inventory? Schedule a demo of RateOptics™, our ad pricing software.

Last updated on October 14, 2025