The Future of TV Advertising in Canada Conference 2021 Recap

Last week I spent a (virtual) day with some of the leading experts in the Canadian television scene at The Future of TV Advertising Canada conference. Topics ranged from the pandemic rebound, to innovation in the media marketplace, to Canada’s increased consumption of streaming.

Pandemic Rebound

Darrick Li — Managing Director of Standard Media Index (SMI), covered pandemic media spend trends and noted that Canada took a larger hit to ad spend than other countries during the height of the pandemic.

In fast-forwarding to today, advertisers are once again seeing the value in linear TV and as a result are paying higher rates. SMI’s graphical representation of Corus TV rates proved that 2021 spot rates are significantly higher across Corus’s major TV networks than the previous two years.

Leverage your content to achieve stronger revenue outcomes

Canada’s overall media spend was up a whopping 77% YOY in Q2, driven heavily by CPG and Automotive in television in the first half of the year. The entire SMI presentation can be viewed here.

Innovation in the Media Marketplace

The always-captivating David Phillips — President and COO of NLogic led an engaging session on an innovative new ad tracking platform — Adgile’s Catalyst dashboard.

Adgile, in partnership with NLogic, has imported Catalyst to Canada to capture real-time, deep intel on TV advertisements across nearly all160 Canadian television channels.

Catalyst differentiates itself in the space in terms of speed and functionality as it goes beyond the ability to solely view and track advertisements. It also provides measurement, attribution, ad optimization, and conquesting capabilities.

In Philips’ highly entertaining presentation themed around waiting (which used pictures of his kids screaming “are we there yet?!”, National Lampoons, etc.) he declared that, “the end of waiting for real-time TV campaign data in Canada is finally here.”

The Increased Consumption of Streaming in Canada

Many of the panelists agreed that compared to other countries, the Canadian media buying marketplace has experienced a slower adoption of streaming TV. However, the momentum in streaming is increasing and it holds the key to advertising growth for both broadcasters and other content providers.

Damien Véran — SVP at sell-side platform Magnite shared that advertising requests for Connected TV is 10x higher than 18 months ago. Christina Summers — Country Manager for Roku Canada added that audiences are shifting to digital and marketers are starting to follow. Summers went on to state that 77% of the Canadian population is now watching streaming monthly with 46% of those streamers expanding their OTT viewership by signing up for additional streaming services in the last 12 months.

Execs from Canada’s largest TV organizations – Corus, Rogers, and Bell – also weighed in on their abilities to capture audiences amongst changing television consumption behaviors in Canada.

Greg McLelland — EVP & CRO of Corus made the point that Canadians are consuming as much, if not more content than ever before. He went on to tout Corus’s STACKTV, a streaming option offering Corus programming for Amazon Prime members as a key ingredient in maintaining Corus’ viewership amongst evolving media consumption habits. “When we combine the STACKTV audience with the viewership on the same twelve linear channels, the audience is actually flat to slightly up.”

Alan Dark — SVP of Revenue at Rogers concurred with McLelland on the ability to maintain audience numbers. “There’s been a lot of fake news about the death of cable in Canada, and while there has been some slight erosion in traditional cable services, we are picking up those viewers in our new digital services.” Alan noted that Rogers has seen rapid growth in their sports and news business due in part to the ability to creatively integrate clients into the content of their programming.

Perry MacDonald – VP Advertising Sales and Sponsorships at Bell continued the theme of setting the record straight on streaming went by sharing, “There’s an increase in people who subscribe to both TV and OTT services in Canada…content is king and that’s the stuff that drives viewers whether it’s to traditional linear TV, Direct Consumer, OTT, whatever the case may be.” In connecting advertisers to viewers, MacDonald talked about Bell’s innovative Strategic Audience Management (SAM) tool, which seamlessly connects Canadian media buyers to audiences across digital and traditional media.

Speaking of Innovation and Maximizing Ad Revenue…

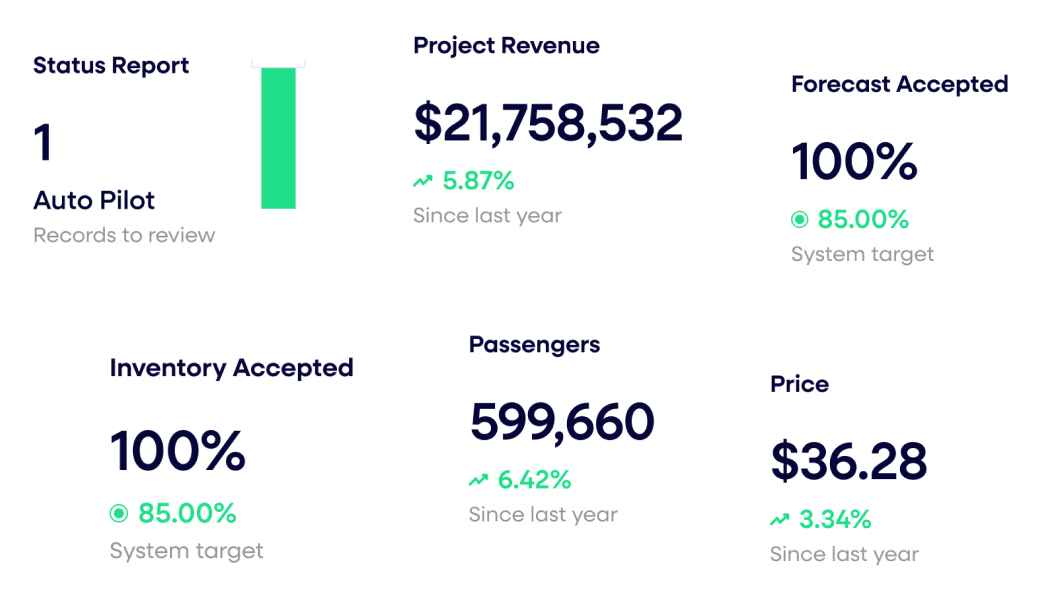

The RateOptics™ platform is being used by Canadian TV and radio organizations to make revenue maximizing pricing decisions at lightning speed while providing visibility into advertiser rates and insights across the organization. The result: broadcasters are driving rates and revenue across their most valuable inventory – inventory that is in high demand as Canadian content continues to dazzle during the economic recovery.

Ready to maximize the revenue of your valuable content? See how RateOptics can help.

Last updated on August 20, 2025