Say goodbye to clunky, dated software.

Say hello to the first and only modern RMS.

Use automation to give all of your O/Ds—not just a lucky few—the attention they deserve.

You don’t have time to update every fare every day. You have no choice but to "set and forget" most routes, but it’s costing you big.

Let our software automate your busywork away so you can make daily updates at scale and scoop up more revenue.

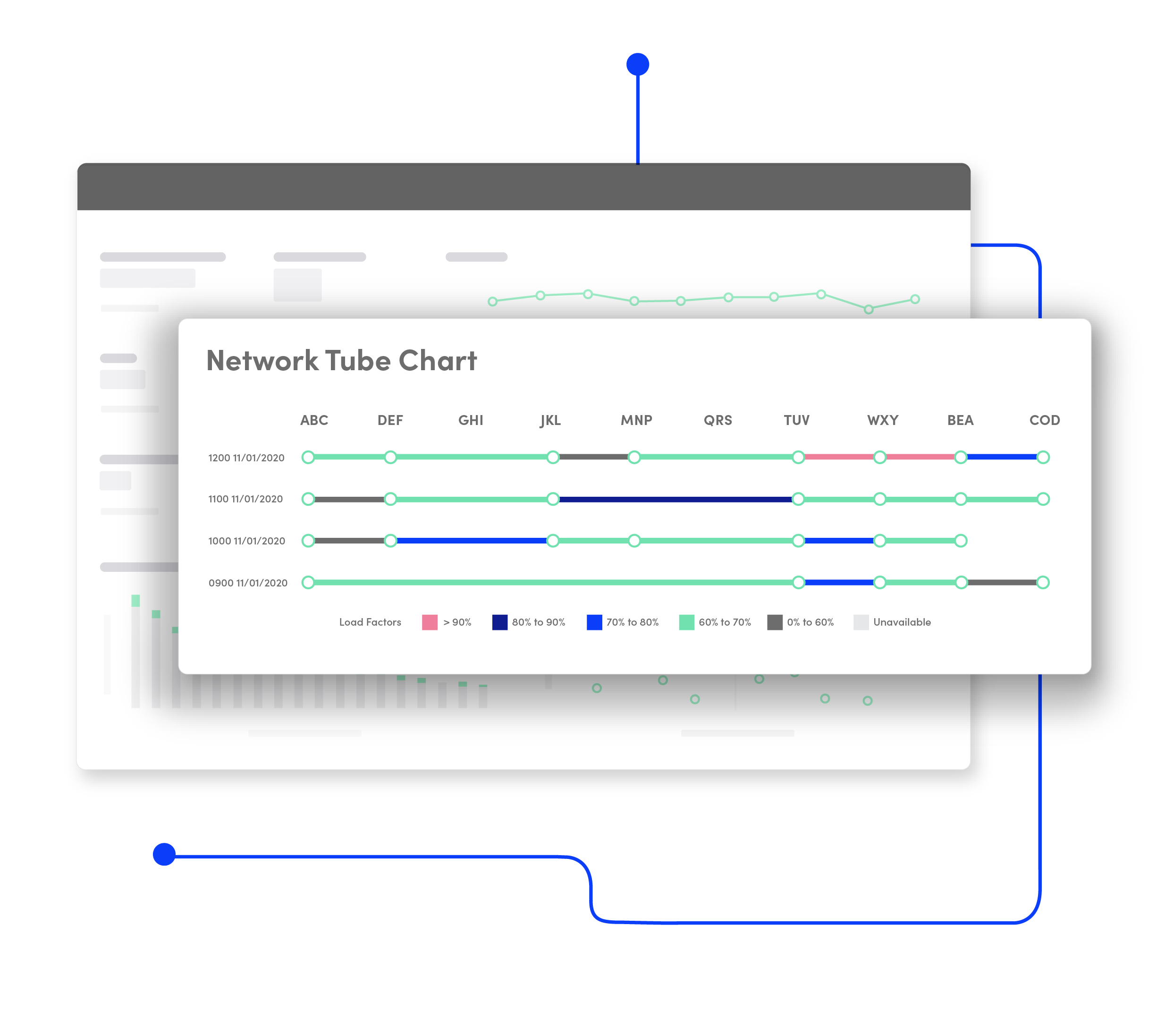

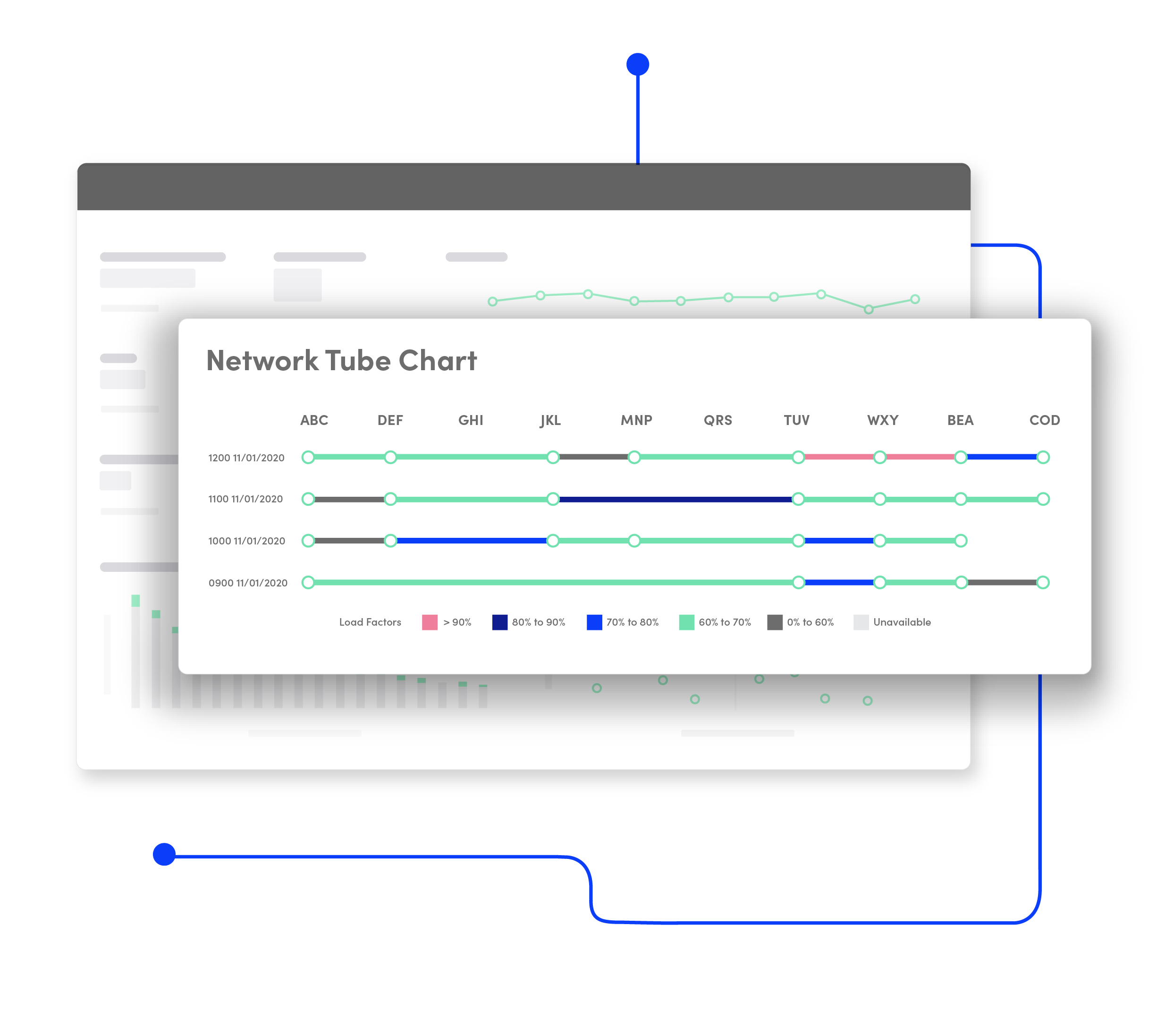

Manage customer volatility and network changes like a champ.

Change…it happens. Shifting timetables, walk-up demand, engineering work, sports events, competitor pricing, and more.

Why not let automation do the heavy lifting for you? When change comes knocking, FareVantage™ will do the talking.

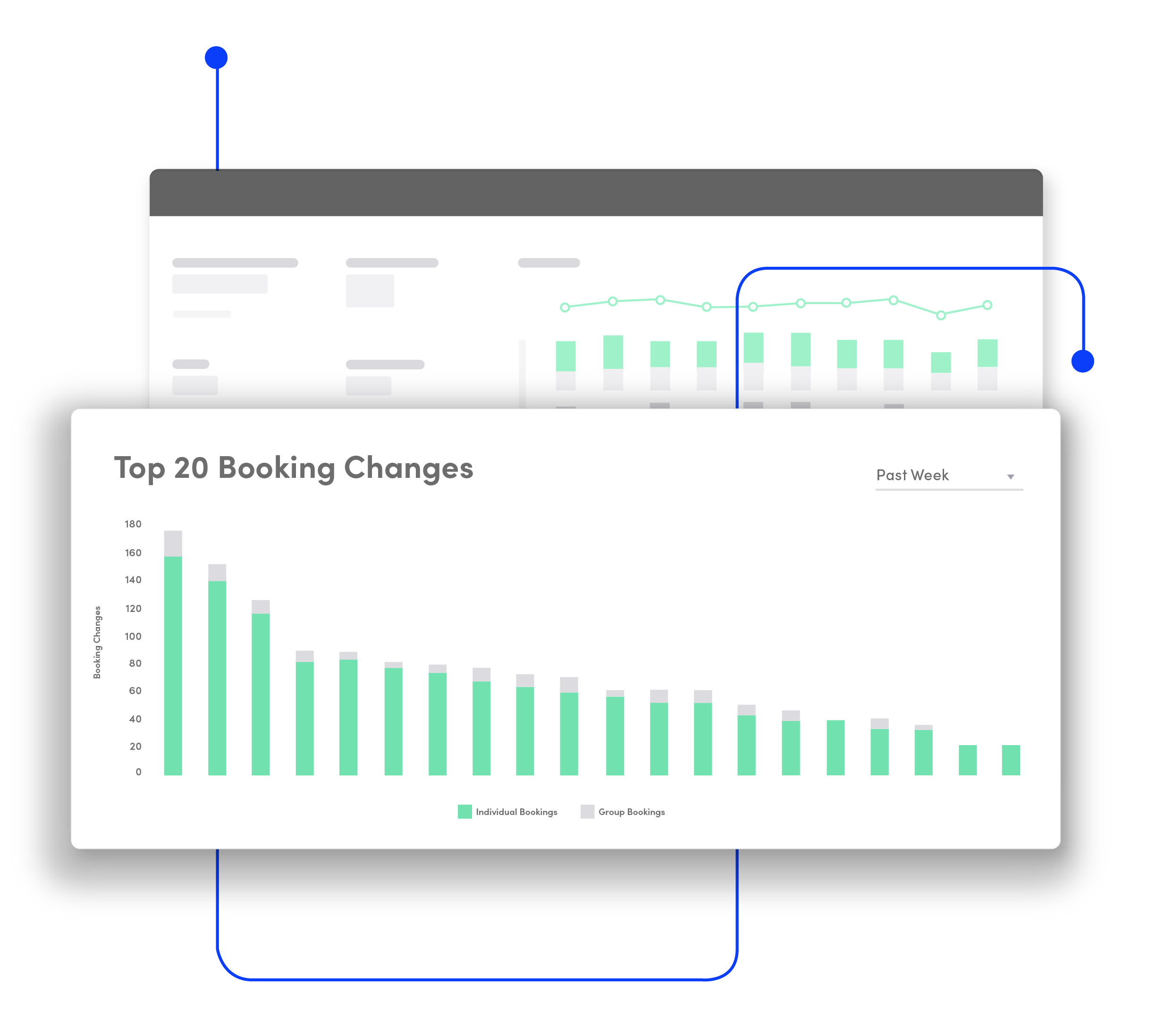

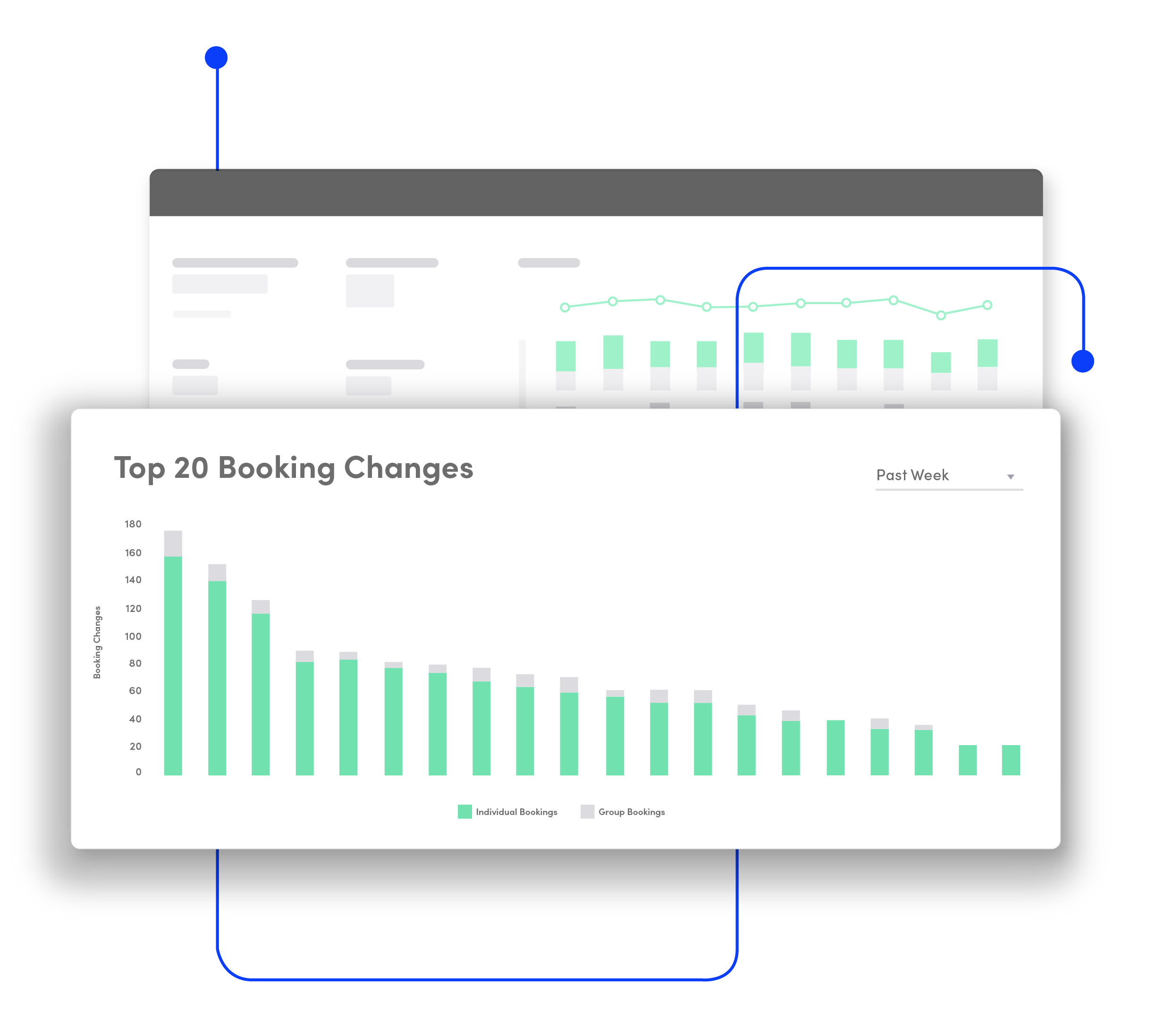

What if finding the important revenue levers wasn’t like finding a needle in a haystack?

When you manage thousands of O/Ds, you don’t have time to wade through every single price recommendation.

FareVantage™ can tell you where to focus, what to do, and why. All so you can make outsized impact with your time.

With fare recommendations this good, you can skip review. Do strategic work instead.

Your team could do higher-level work, but they have to slog through an endless stream of recommendations. Not anymore.

FareVantage™ gives you recs you can trust to maximize revenue and make sense in the real world. And you get 50% of your time back.

Try real analytics on for size. Get state-of-the-art pricing science and 3-7% more revenue.

Business rules—you can use them, but then you lose…both revenue and passengers. Simple as that.

You won’t find a bunch of business rules here. Just advanced analytics from the founders of RM, and more revenue too.

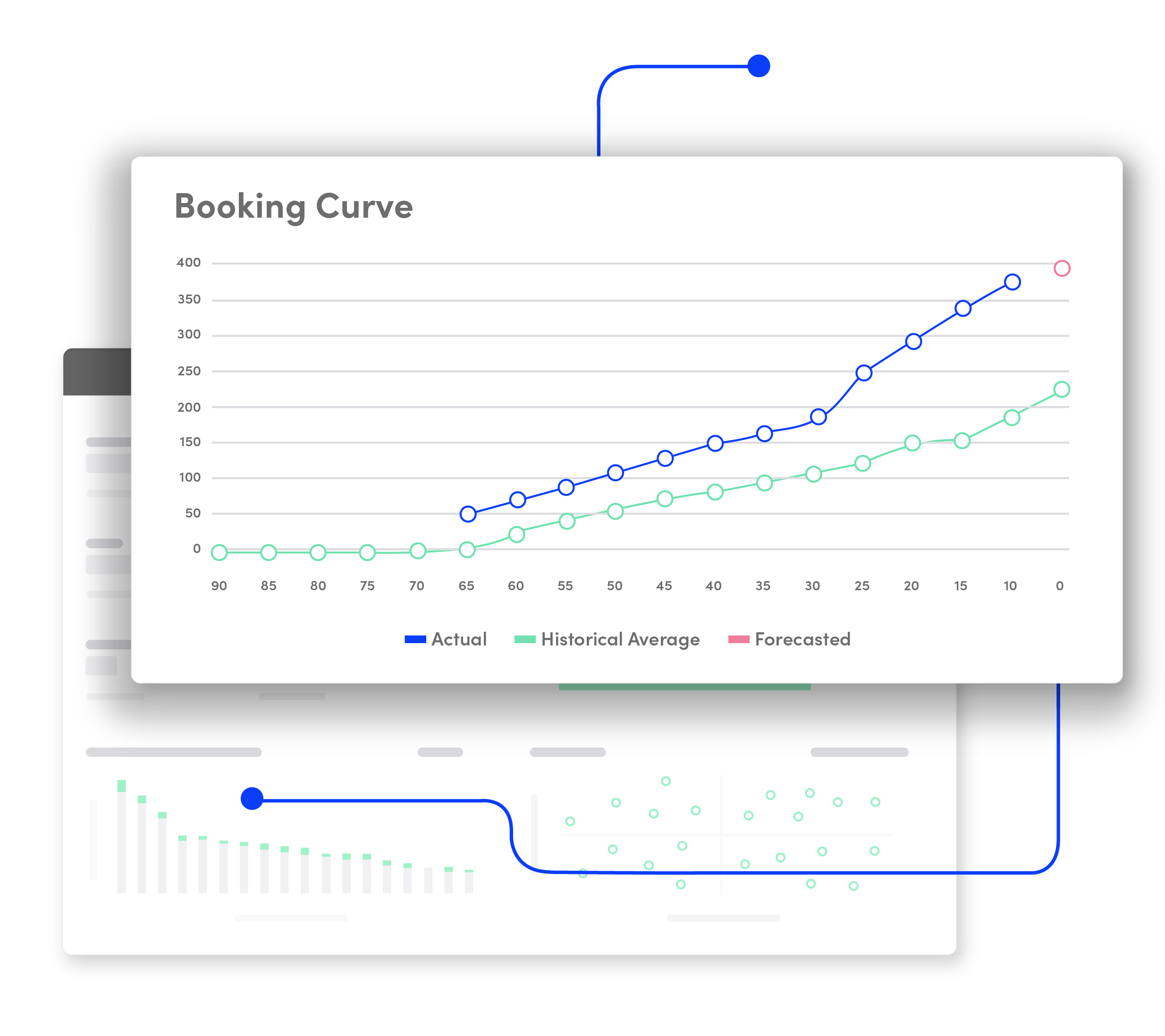

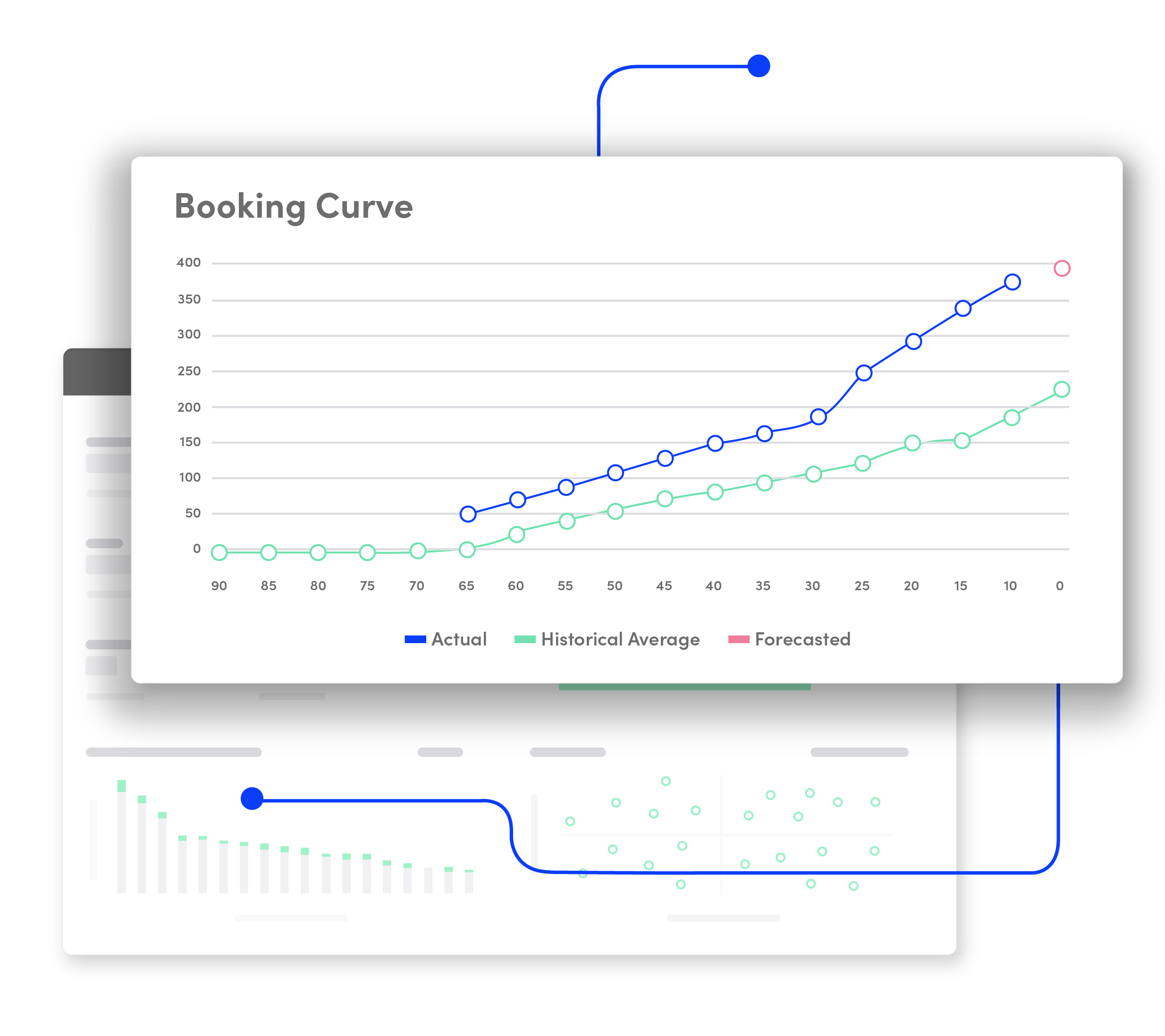

Kick your sports & events forecasting into high gear with a forecast that views demand through the customer lens.

Stuck forecasting just advanced bookings? FareVantage™ is the first software that factors in walk-up demand.

Everything hinges on your forecast. That’s why we built you the best—35% more accurate than the rest.

Leg and train-level pricing makes journeys too costly. Price at the journey-level to uncork demand and revenue.

When schedules changes strike, FareVantage™ adjusts pricing for you auto-magically. Just the way it ought to be.

Imagine all the big revenue opportunities organized into a central view you control. That’s the priorities dashboard.

Wouldn’t it be great if intraday pricing was actually possible? We thought so too. So we turned the dream into reality.

FareVantage™ Plays Well with Others

Share data back-and-forth with reservation systems. Embed our insights in any BI tool. Use our standard integrations or let us build you something custom. The sky is the limit with our open API architecture.

Want all the best tools at your disposal? We’ve got you covered with these cutting-edge add-ons.

We know that your business needs more than lightweight solutions. We have powerful analytics purpose-built for Rail operators.

We know you’re leery of people who say, “Do it our way.” FareVantage™ is designed to be flexible so it works the way you need it to.

We know you’re tired of vendors touting Artificial Intelligence. We have the right people building the right tech to fit your needs. That’s it.

We know you don’t have time to be experts at everything. We have 15+ years of Revenue Management expertise built into our software.