Pricing Discipline: The Fastest Value Creation Lever in Private Equity

Across private equity portfolios today, one message is becoming clear: revenue gaps are widening. Forecasts are harder to hit, margins are under pressure, and volatility has made traditional levers less reliable.

While CFOs can’t close these gaps alone, there is one lever that consistently delivers fast, scalable impact when executed well: pricing discipline.

Not one-time price increases.

Not episodic pricing studies.

But disciplined, repeatable pricing execution embedded into daily operations.

For private equity leaders, CFOs, and operators, pricing discipline represents one of the fastest, lowest-risk paths to EBITDA improvement available.

See how private equity firms turn fragmented data into repeatable value creation across portfolios.

Pricing Is Powerful — But Only When It’s Disciplined

Most portfolio companies don’t lack pricing strategy. They have price lists, discount policies, approval workflows, and contracts. On paper, the framework exists.

The problem is execution.

In practice, pricing decisions are fragmented across sales, finance, and operations. Sales teams negotiate in the field with limited guidance. Finance teams discover margin erosion after the quarter closes. Operators focus on volume while pricing governance remains reactive.

The result is margin leakage that compounds quietly.

Small discounts that feel inconsequential in isolation add up across hundreds or thousands of transactions. Legacy contracts drift from intended economics. Inconsistent pricing behavior undermines forecast accuracy. By the time leadership sees the impact, the opportunity to course-correct has passed.

But this isn’t a lack of effort.

Why Pricing Discipline Is the Easiest Value-Creation Lever

Compared to other value-creation initiatives, pricing discipline stands apart for three reasons.

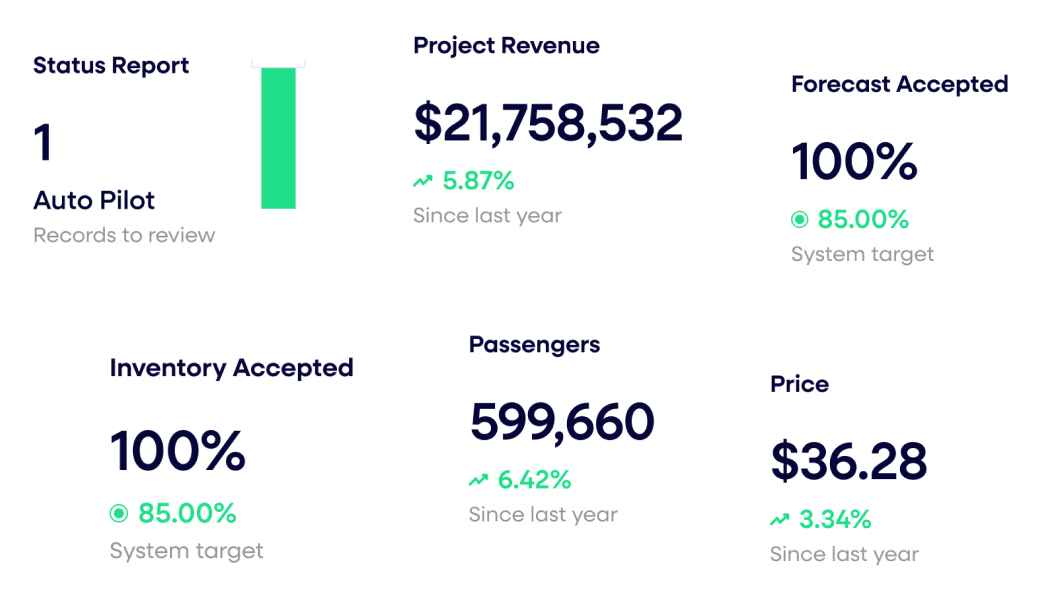

First, it delivers immediate EBITDA impact. Pricing improvements flow directly to the bottom line. There’s no dependency on volume growth, no long implementation cycles, and no operational drag. Even modest improvements in realized prices can materially increase margins within a single quarter.

Second, pricing discipline scales across the portfolio. Unlike bespoke operational initiatives, pricing discipline can be standardized and governed. Once guardrails, visibility, and accountability are established, the same approach can be deployed across multiple portfolio companies — even when systems and maturity levels differ.

Third, pricing discipline reduces risk as much as it increases return. Improved pricing visibility leads to more reliable forecasts, fewer quarter-end surprises, and more predictable performance. In today’s environment, predictability is a form of value creation in its own right.

The CFO’s Role: From Price Police to Value Architect

Historically, CFOs have been pulled into pricing too late — approving discounts after deals are negotiated or explaining margin misses after the fact. That dynamic positions finance as the “price police,” creating friction without solving the underlying issue.

Pricing discipline changes that role.

With real-time visibility and shared pricing guardrails, CFOs move from reactive oversight to proactive guidance. Finance no longer audits outcomes; it helps shape them. Risks surface while decisions are still in motion, not after they’re locked in.

For operators, this creates clarity rather than constraint. Sales teams move faster when expectations are clear. Leaders spend less time debating anecdotes and more time making informed decisions. Pricing becomes a managed operating capability, not an emotional negotiation.

What Pricing Discipline Looks Like in Practice

Pricing discipline isn’t about saying “no” more often. It’s about creating consistency, transparency, and confidence across the commercial engine.

Disciplined pricing environments typically share a few core characteristics:

- Clear pricing guardrails aligned to margin and value strategy

- Real-time visibility into exceptions and outliers

- Shared data across pricing, sales, and finance

- Ongoing coaching that improves behavior over time

When these elements are in place, pricing decisions become faster, more consistent, and easier to defend. A strong pricing discipline enables teams to pursue the right deals confidently while avoiding unnecessary margin giveback.

Why Pricing Discipline Matters More in Today’s Market

Volatility has exposed the limits of static pricing approaches. Inflation, supply chain disruption, and shifting demand patterns mean yesterday’s assumptions rarely hold for long. Annual price increases and static price lists can’t keep pace with real-time market conditions.

In this environment, undisciplined pricing creates compounding risk. Margin erosion accelerates quietly. Forecast confidence declines. Operators spend more time firefighting and less time executing strategy.

Pricing discipline provides stability. It gives leaders visibility into what’s happening now — not what happened last quarter. It enables faster adjustments without overreacting. And it creates a durable foundation for value creation even as markets shift.

The Bottom Line for PE Leaders and Operators

For private equity firms looking to unlock value quickly and responsibly, pricing discipline deserves a central place in the value-creation playbook.

It doesn’t require restructuring the business.

It doesn’t depend on external tailwinds.

And it doesn’t introduce unnecessary operational risk.

When pricing decisions are aligned across sales, finance, and operations, the results are immediate and durable: stronger EBITDA, better forecasts, and more predictable outcomes.

In a market where control is limited, pricing discipline is one lever that PE leaders, CFOs, and operators can actually own — and one that pays off faster than almost any other.

Go deeper on the CFO’s role in pricing-led value creation.

See how CFOs in PE-backed companies are closing revenue gaps, strengthening EBITDA performance, and improving forecast confidence by aligning pricing, sales, and finance. Read the full white paper: The CFO’s Guide to Closing Revenue Gaps: Breaking Down Silos Between Pricing, Sales, and Finance to Drive Growth.

Last updated on January 27, 2026