Why Revenue Gaps Are Widening — and Why CFOs Can’t Fix Them Alone

CFOs today are under more pressure than ever. Volatility is higher. Forecasting is harder. And expectations from boards, investors, and operating partners continue to rise.

Across private equity portfolios and operating companies, a clear pattern is emerging: revenue gaps are widening, even as finance teams work relentlessly to close them. The issue isn’t effort or discipline. It’s that the nature of the problem has changed — and it can no longer be solved by finance alone.

Revenue Gaps Are Structural Now

In manufacturing and distribution, revenue gaps don’t appear overnight. They build gradually through inconsistent pricing execution, margin leakage hidden in complex catalogs, quoting delays, and market shifts that move faster than annual pricing cycles.

From the CFO’s perspective, the symptoms are familiar: missed forecasts, eroding margins, and pressure to “find another 100 basis points” without clear or repeatable levers. What’s different today is the speed and scale at which these gaps form, and the fact that traditional controls aren’t designed to keep up.

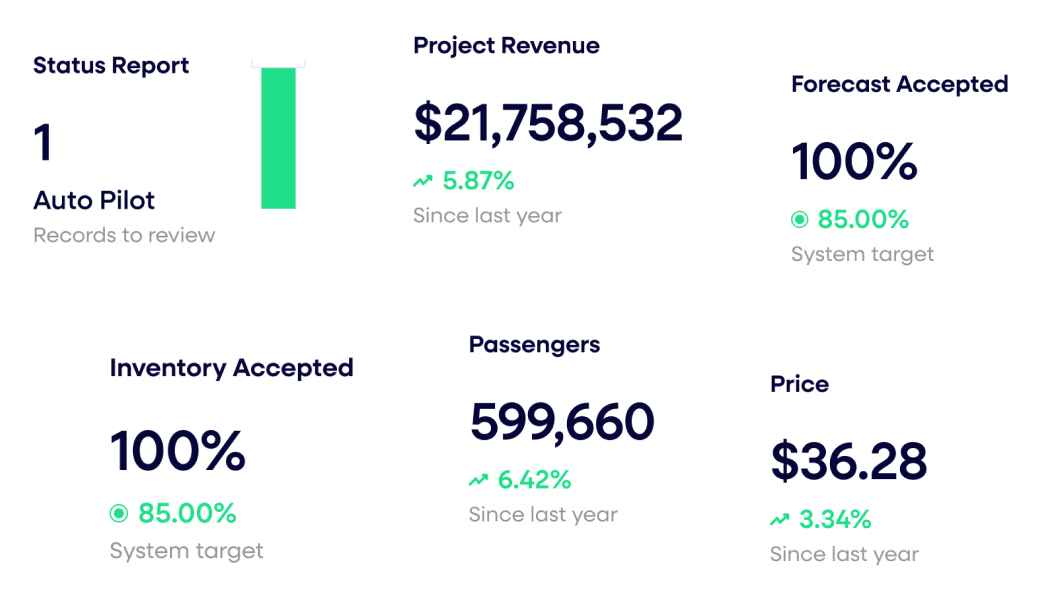

See how leaders turn data chaos into decision-ready intelligence that boosts margin.

Why CFOs Are Being Set Up to Fail (Through No Fault of Their Own)

CFOs are accountable for revenue outcomes, but they rarely control the decisions that drive them day to day.

Pricing decisions happen constantly by sales reps, in quoting tools, across customer segments. Finance typically sees the impact after the fact. Strategy may be defined centrally, but execution is fragmented, data is disconnected, and intervention comes too late.

That creates a fundamental mismatch: CFOs own the number, but not the system producing it. No amount of retrospective analysis can fully close that gap.

A Portfolio-Scale Challenge

In PE-backed environments, this problem multiplies. Each portfolio company has different pricing maturity, systems, and behaviors. From the fund level, revenue gaps don’t just reduce EBITDA, they slow value creation, increase risk, and complicate the exit story.

Pricing is widely recognized as one of the most powerful value-creation levers available. Yet without a scalable way to enforce discipline, it remains underutilized or inconsistently applied.

What Actually Closes the Gap

The companies that consistently narrow revenue gaps treat pricing as an operating capability, not a periodic exercise.

They embed pricing discipline into daily workflows. Finance, sales, and leadership operate from a shared view of performance. Pricing guidance adapts as conditions change, and visibility exists while decisions still matter.

When pricing becomes always-on, CFOs move from reacting to results to shaping them.

Better Leverage, Not More Responsibility

CFOs don’t need more responsibility. They need leverage — real-time visibility, confidence that execution aligns with margin goals, and systems that scale discipline across teams and portfolios by aligning pricing, sales execution, and financial oversight around a shared revenue view.

For the full framework behind this shift, read The CFO’s Guide To Closing Revenue Gaps: Breaking Down Silos Between Pricing, Sales, and Finance to Drive Growth.

Last updated on January 5, 2026